New reality. Turning today’s world disruption into tomorrow’s victories.

CONFIDENTIALITY NOTICE:

The information provided further has materials confidential in nature. Please do no distribute or copy this information other than for the purpose of the evaluation of this submission without prior explicit consent of Sberbank of Russia.

The information provided further has materials confidential in nature. Please do no distribute or copy this information other than for the purpose of the evaluation of this submission without prior explicit consent of Sberbank of Russia.

World’s Best Corporate Digital Bank Awards

Global Finance’s

2021 CORPORATE DIGITAL BUSINESS OVERVIEW

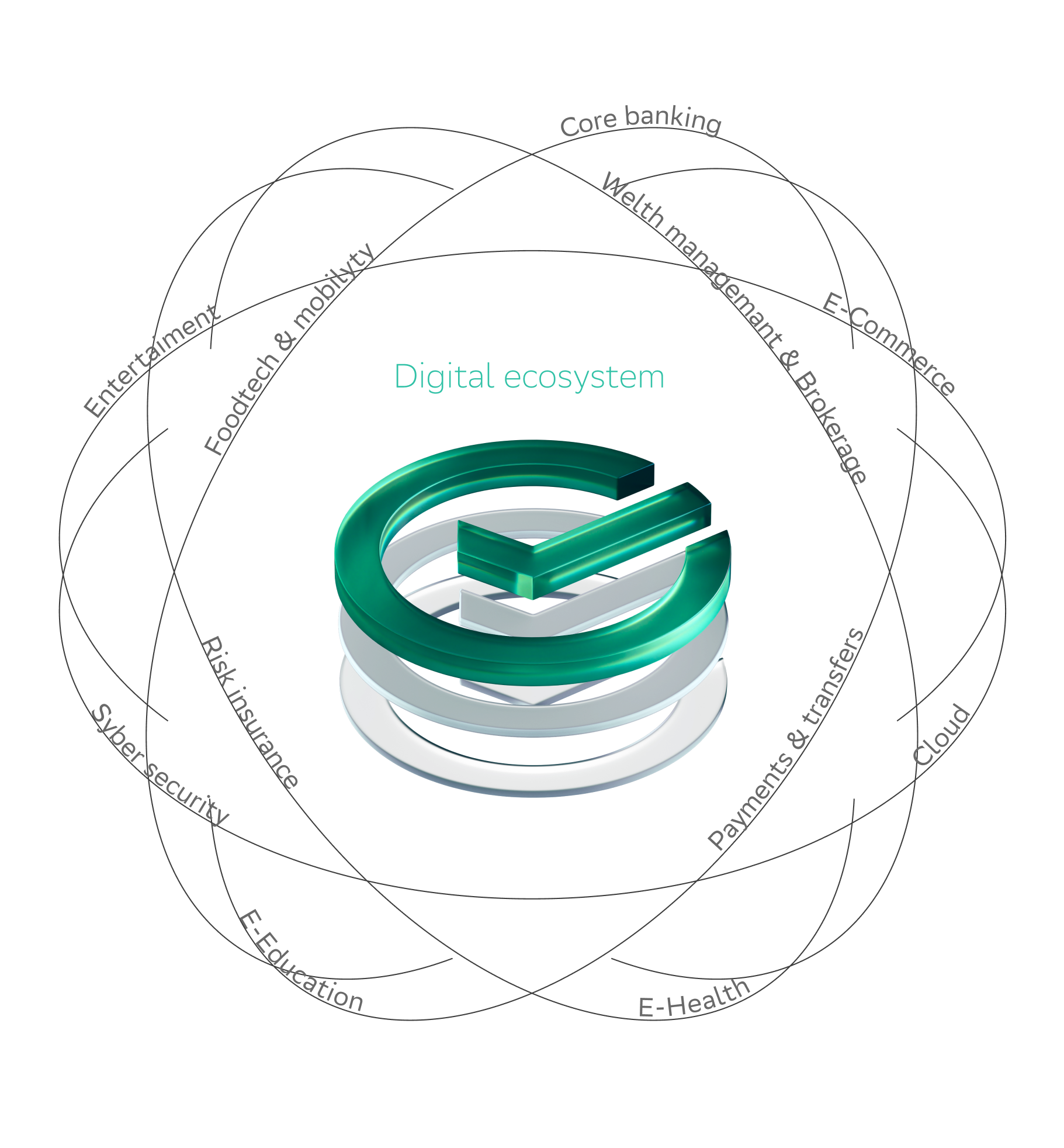

Founded in 1841, SberBank is the largest bank in Russia, Central and Eastern Europe, and the unquestionable digitalization leader. In September 2020, Sberbank officially declared itself an ecosystem, rebranding as Sber.

Today, SBER is more than just a bank

Sber is a trusted assistant that can help navigate through the ever-changing world. It benefits the stable evolution of people, businesses, and the state—by building a fully integrated ecosystem.

active corporate customers

During the COVID-19-driven economic downturn in 2020, we did our best to tailor our products and channels to the changing needs and pain points of our corporate clients. We provided them with continuous service, fully digital processes, 24/7 support in evolving their business models, including through advice on business, fraud prevention, or risk hedging.

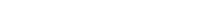

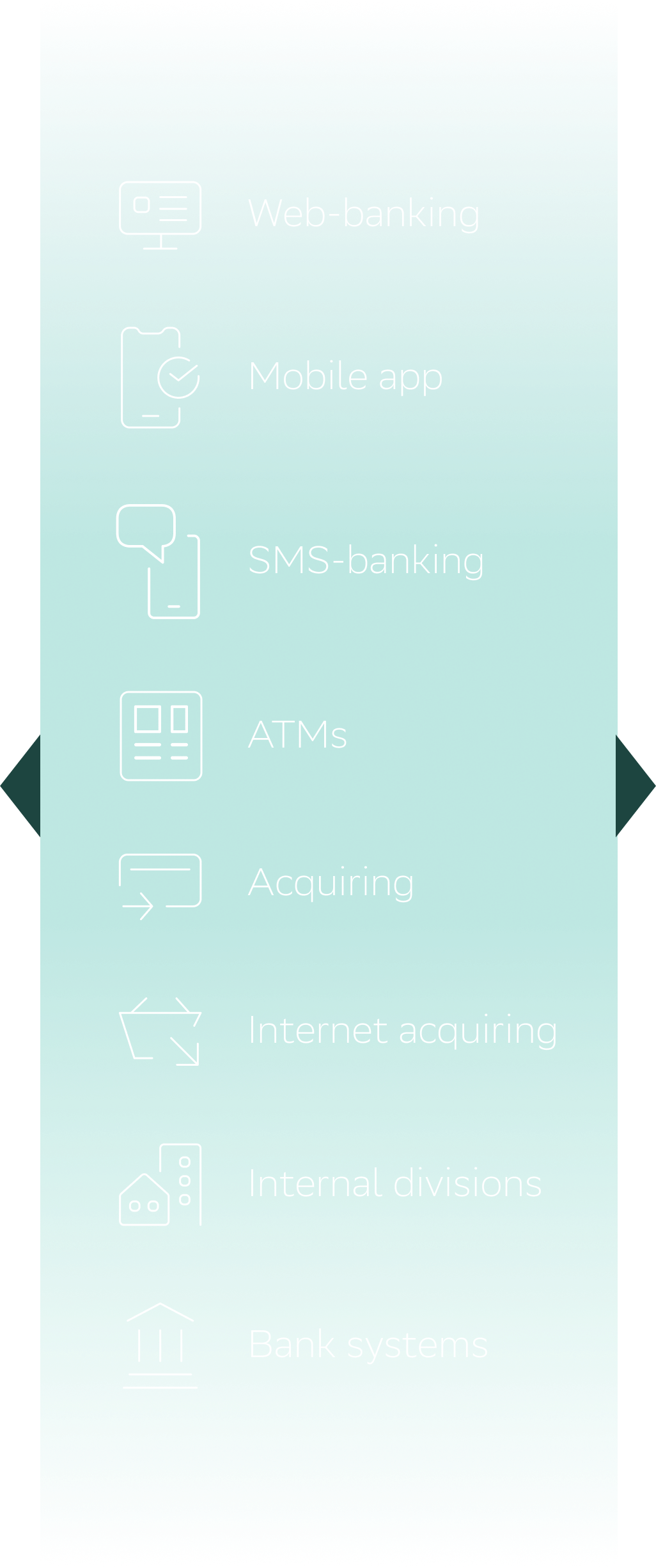

All-embracing, multi-channel approach

Maximum functionality for business clients with single-window access and intuitive UX, desktop & mobile versions.

CSI

active corporate customers

Online trading terminal for advanced corporate treasurers and traders.

active customers

Innovative channel for sales, information, and communication with corporate customers.

monthly visitors

ONLINE

PORTAL

PORTAL

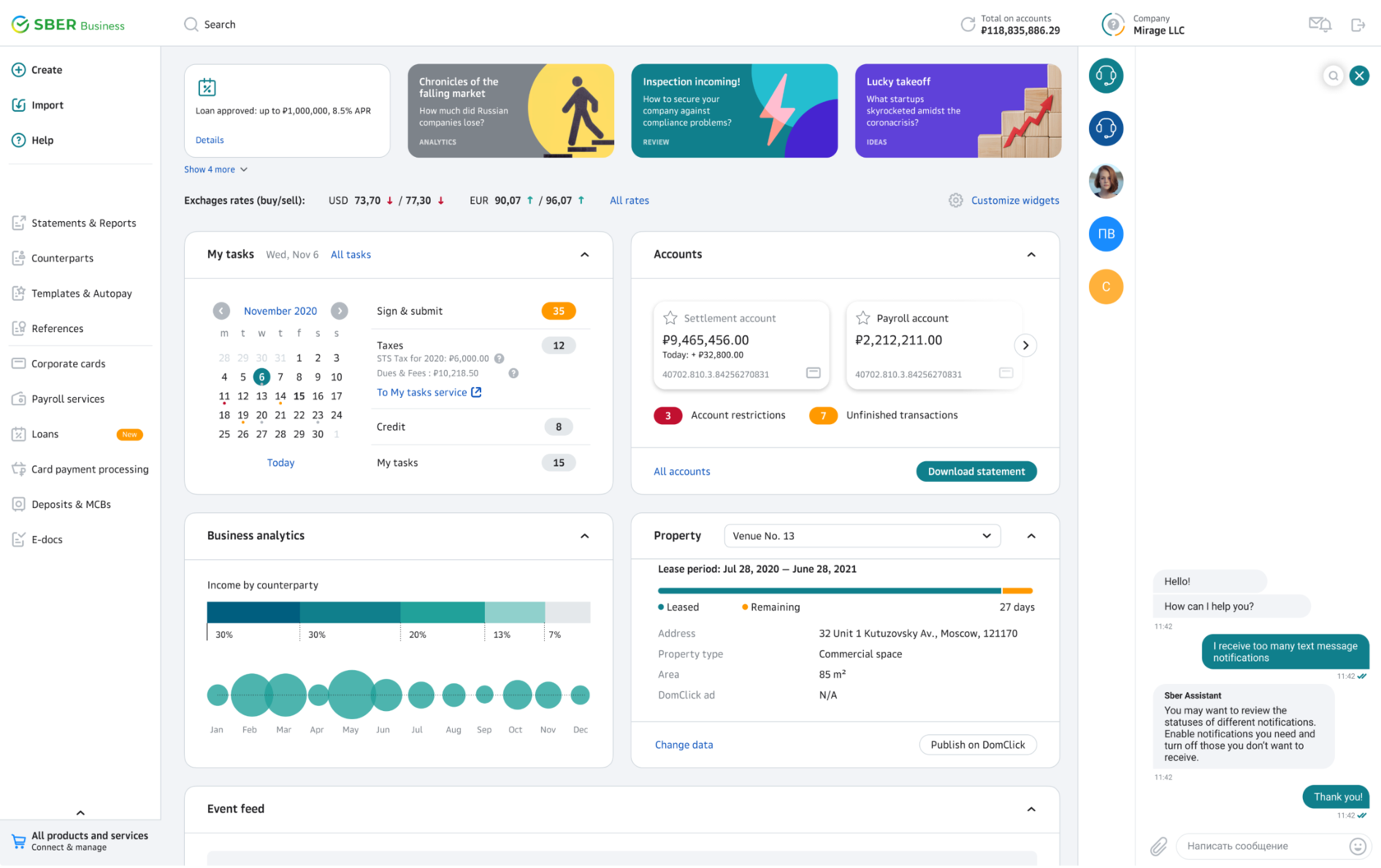

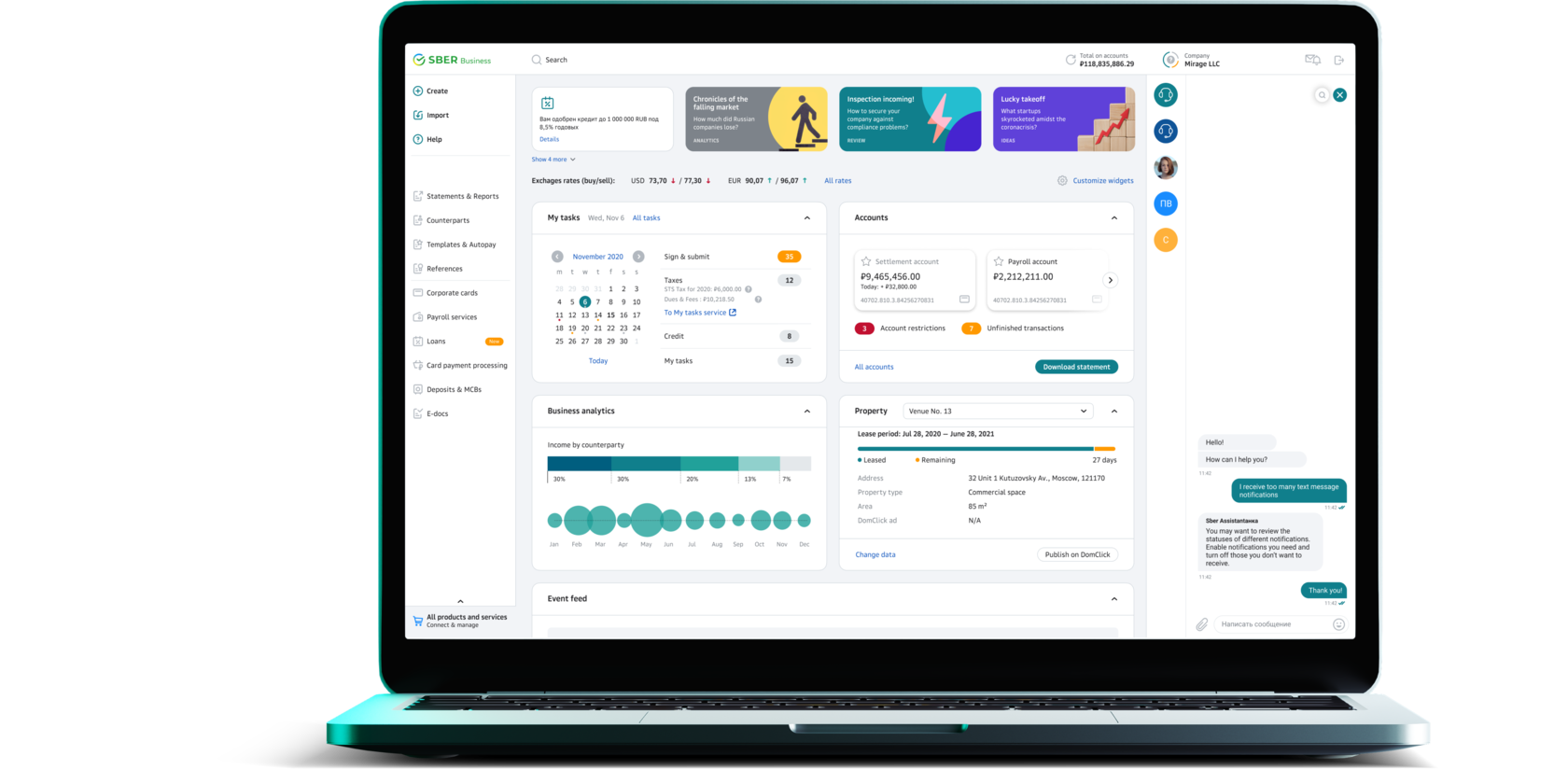

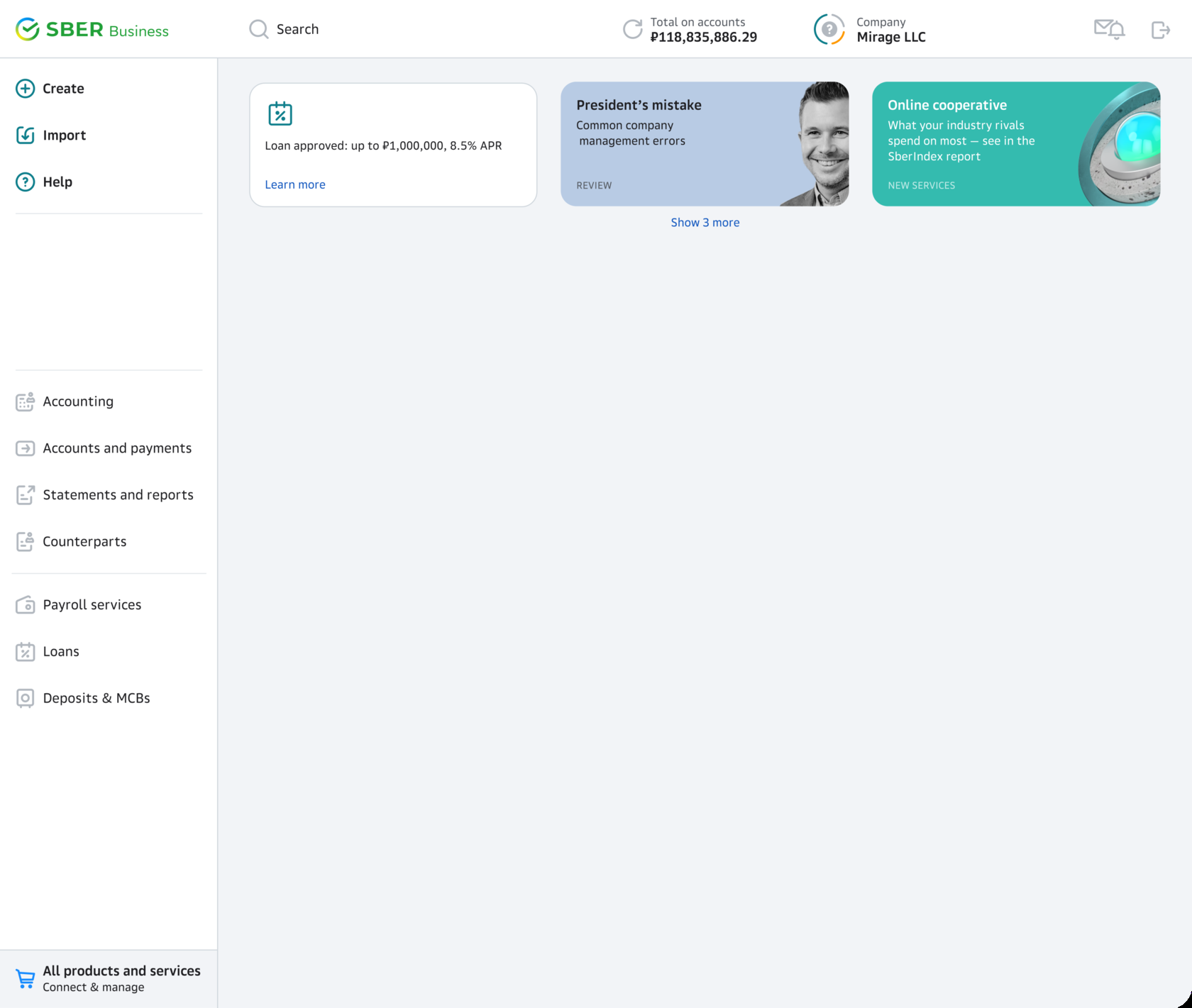

Powerful and versatile platform with multiple customization options

From digital deposits, ultra-fast payments, and convenient loans to advanced functionality of investments, foreign trade, and 50+ non-finance services. Businesses of any size—from the largest to micro companies and self-employed—can find the feature they need in SberBusiness web-bank.

New customers can register their business, reserve new account, apply for a loan and select from wide range of digital services in pre-login zone. Starting from 2021 there is no need to go to the bank, we send couriers for authentification.

Easy onboarding

We added new smart widgets with business analytics, task managers, etc. Users can configure the widgets as they like.

Adjustable menu

Customizable main page

Users can add and delete menu items.

Own/partner company assessment service with the use of official and internal sources, personal recommendations from the Bank, and account blocking risk identification.

Flexible permissions

for team members

(HR, accountant, etc.)

(HR, accountant, etc.)

SberRating

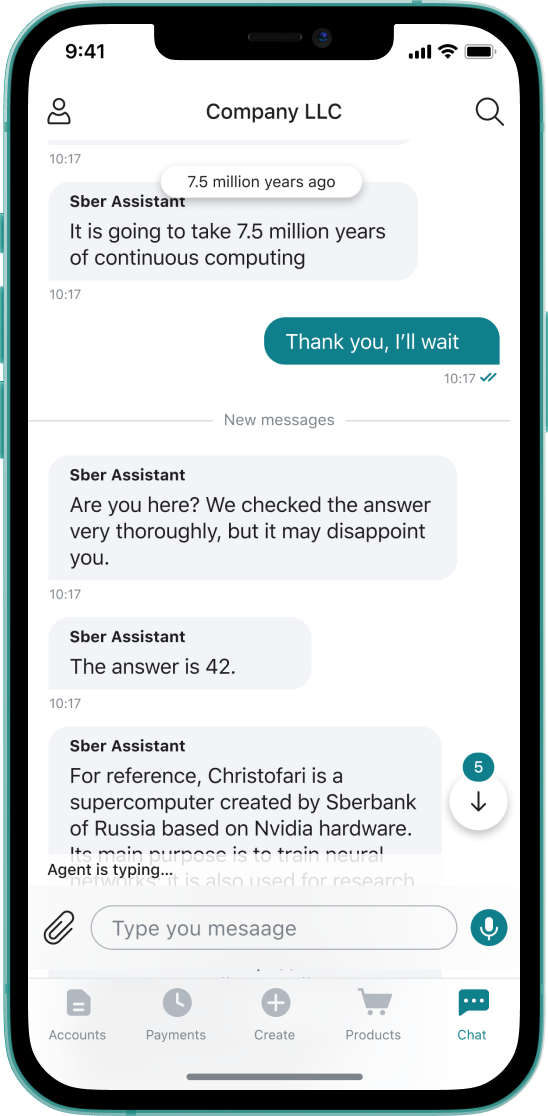

Chat

Live chat offers 24/7 online banking support to help the customer with any question.

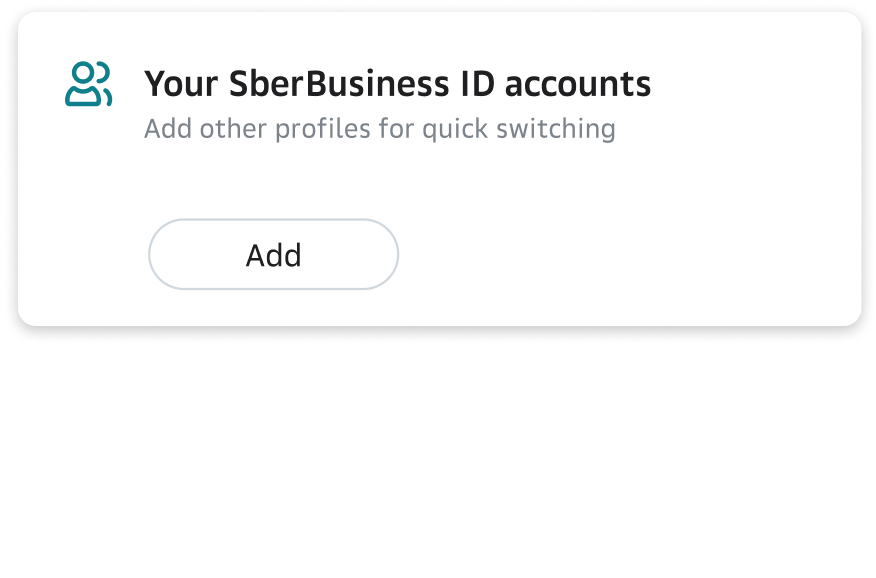

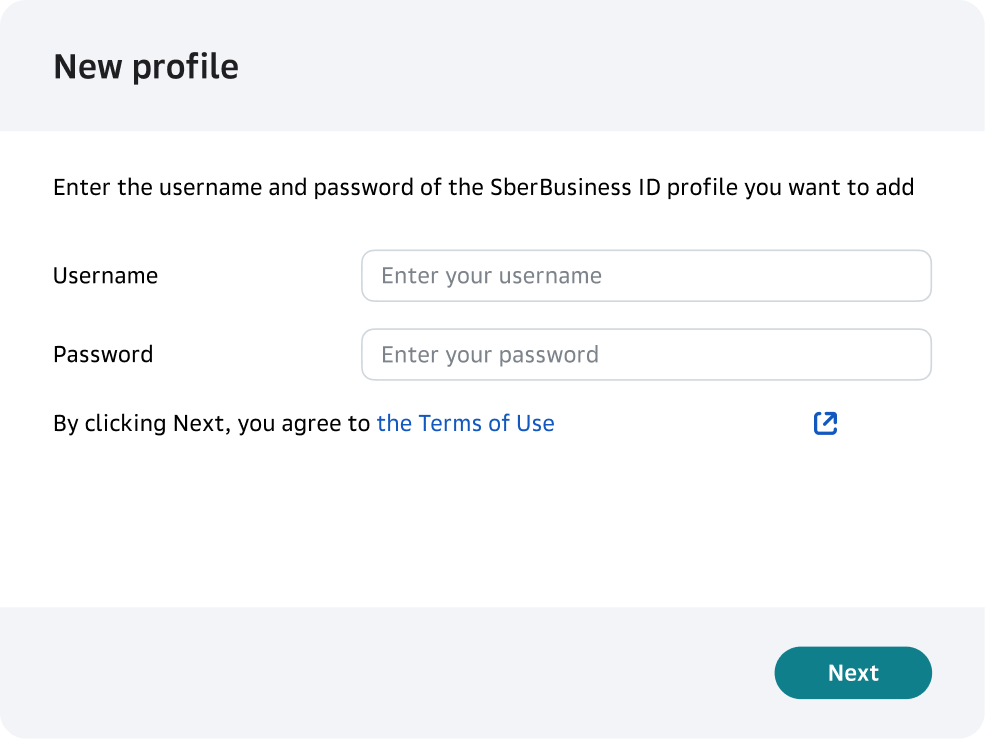

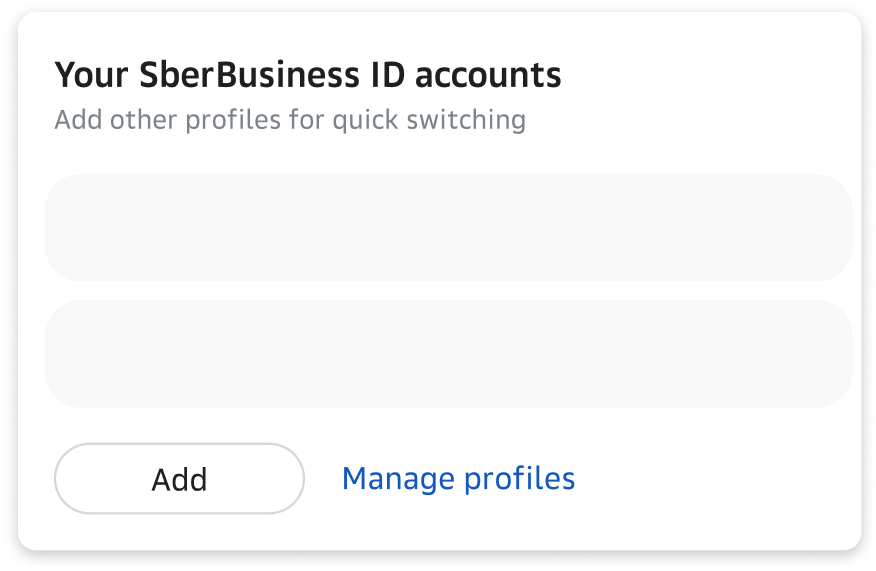

In March 2021, we introduced an option that allows users with several accounts (for instance, managing several businesses) to merge their accounts into a single SberBusiness profile. This helps them switch between accounts without leaving the system.

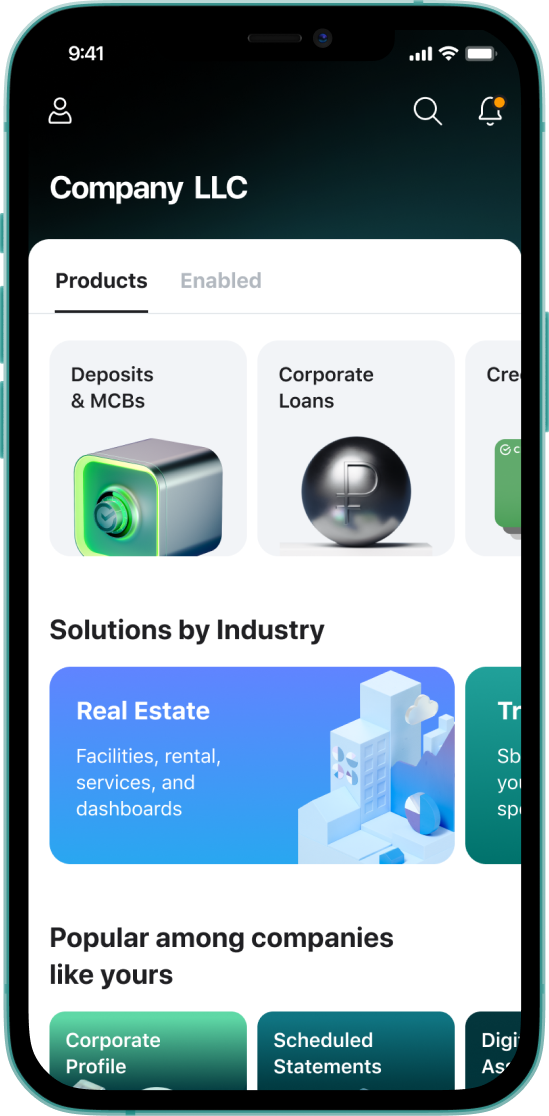

Accounts merging

From segment-wise customization (large businesses, CIB, SME), we went further and introduced industry-specific solutions. First industry solution for Rental Properties was launched in March 2021. We plan to extend the line of custom solutions to Transport, Services, Medicine, and other verticals till the end of the year.

Internet-Bank-As-A-Service approach

Rental Properties

Services

Transportation

Retail

Wholesale

Medicine

Housing & Utilities

Over the past few years, the number of digital services integrated into our web bank has reached 50+ (third parties, government, etc.). Thanks to the API technologies in place, users enjoy ultimately smooth and seamless experience of switching between different services: from CRM and online promotion to advanced analytics and tax services.

For the convenience of our business customers from different industries we picked only the services they need, integrated them into their business scenarios, and now offer these 'smart packages' in the form of widgets and tools in the web-bank. Business customers from various industries can now customize their SberBusiness profile to their specific needs.

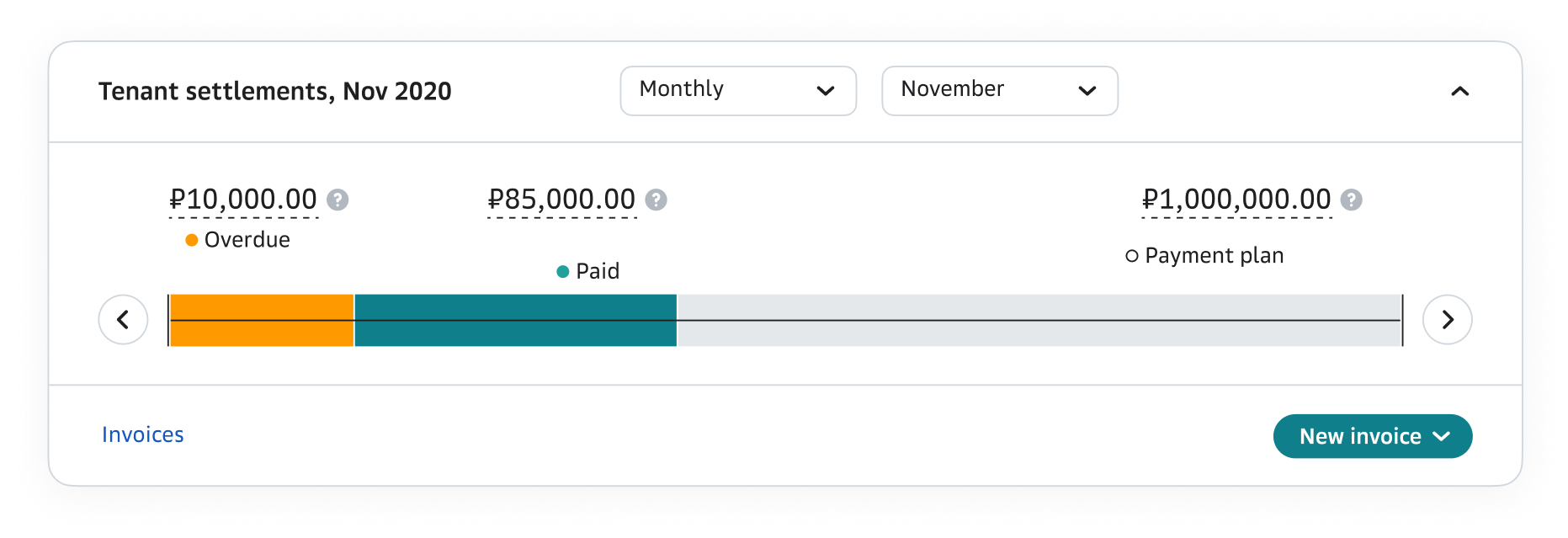

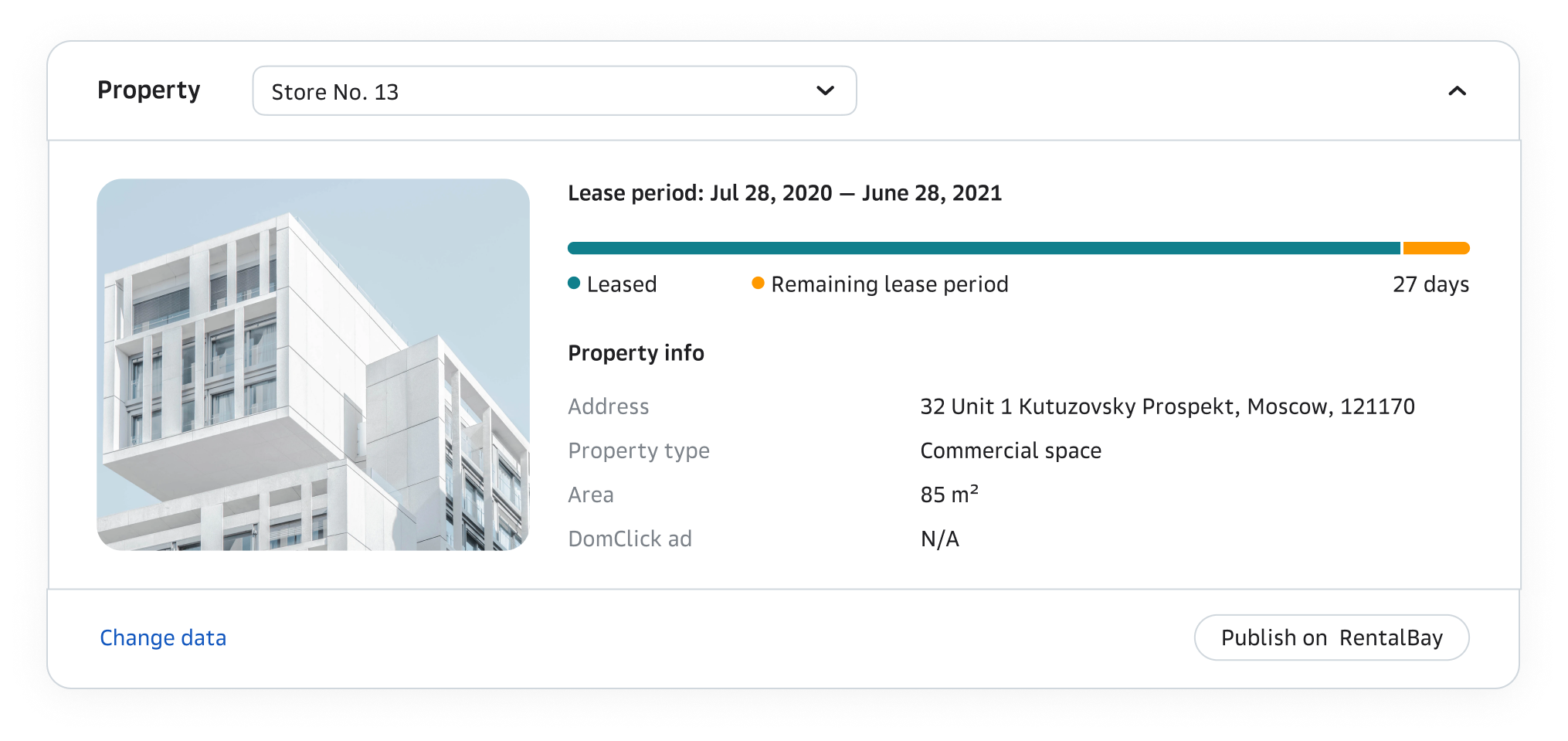

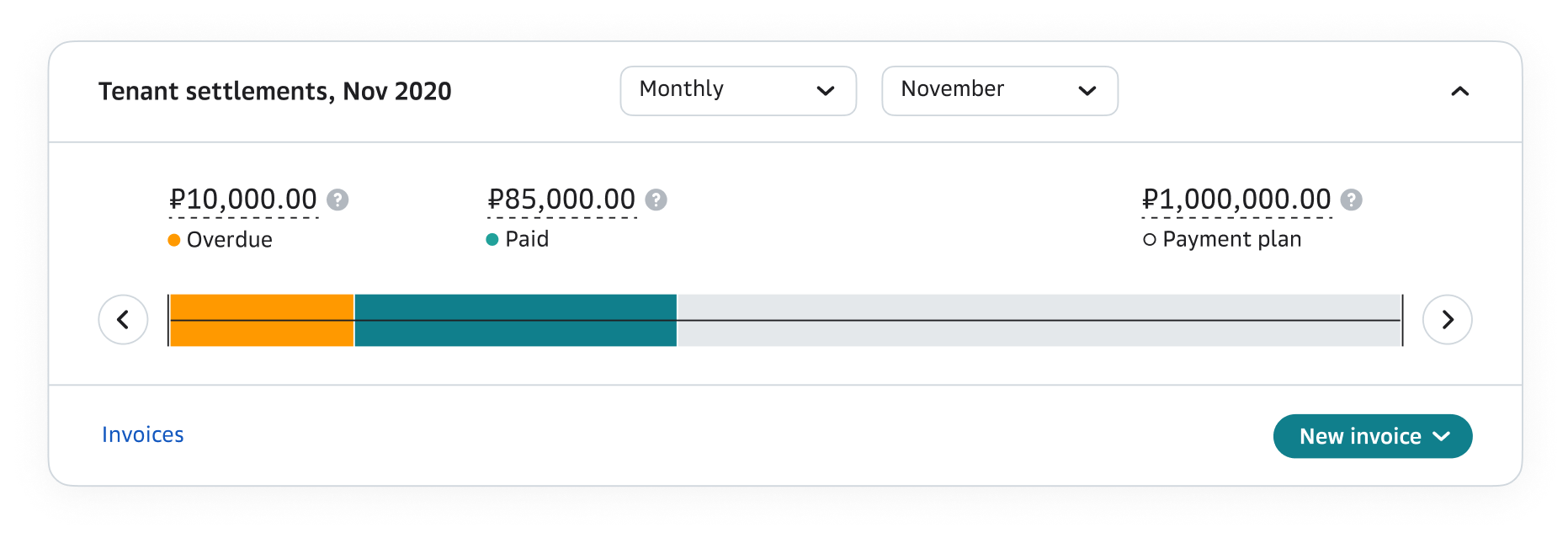

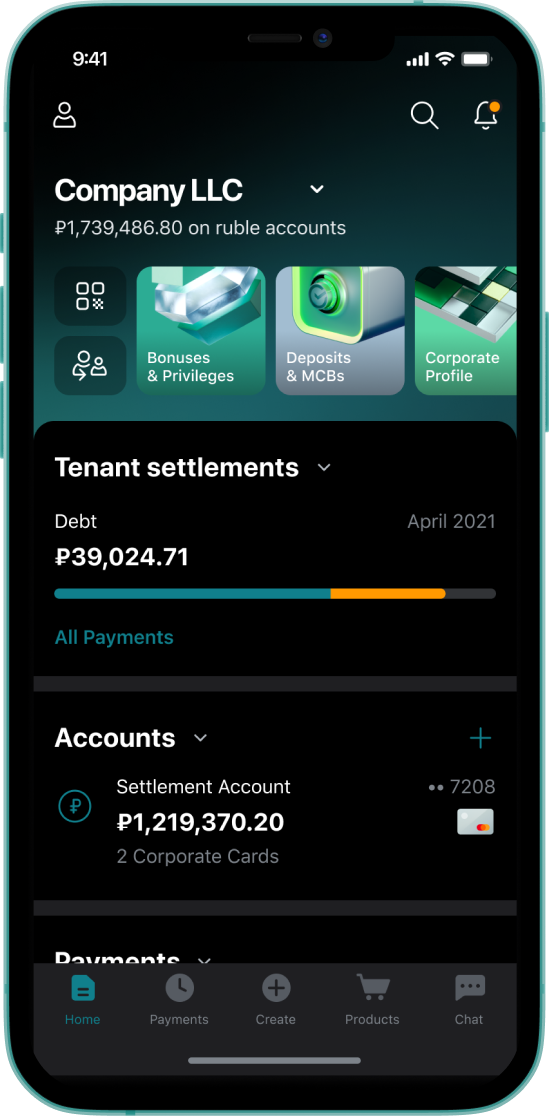

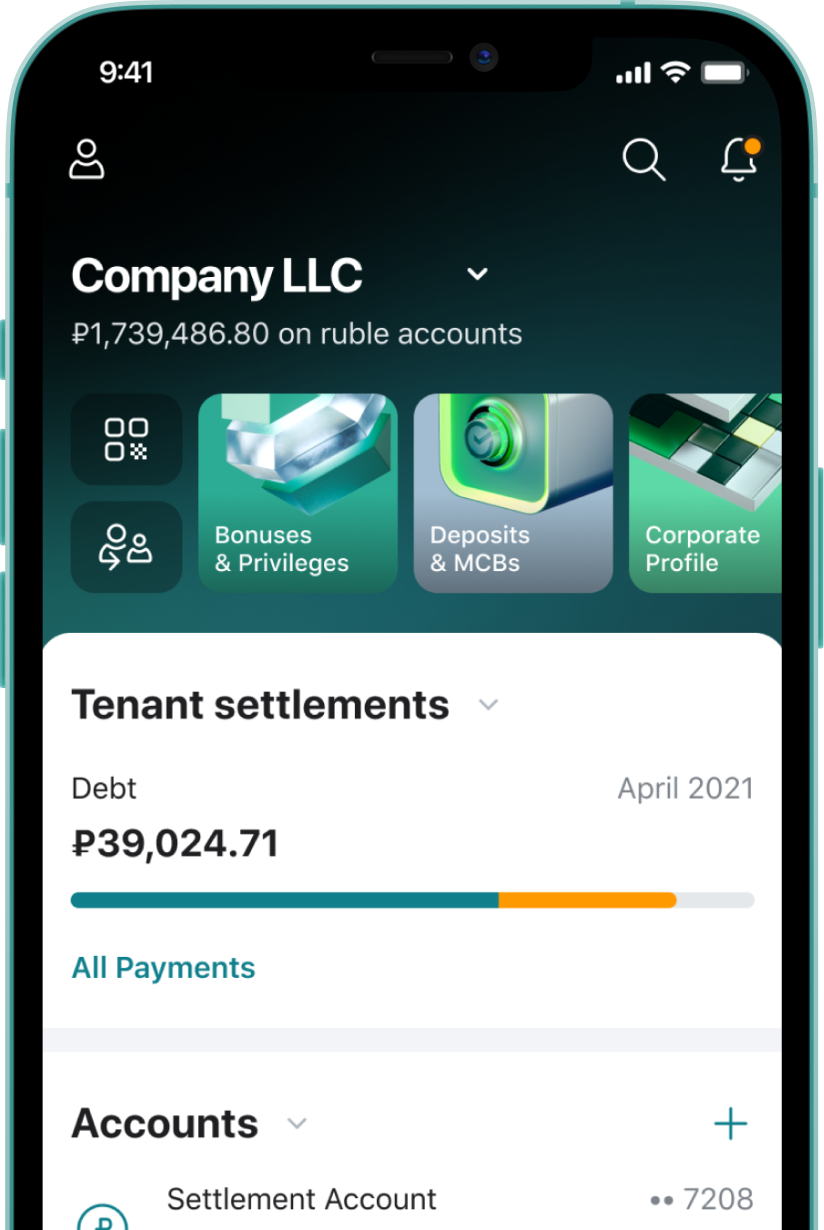

The Tenant settlements widget displays up-to-date information about the payment schedule and monthly debt. With all these details at hand, a user can size up a situation and take prompt measures to collect arrears.

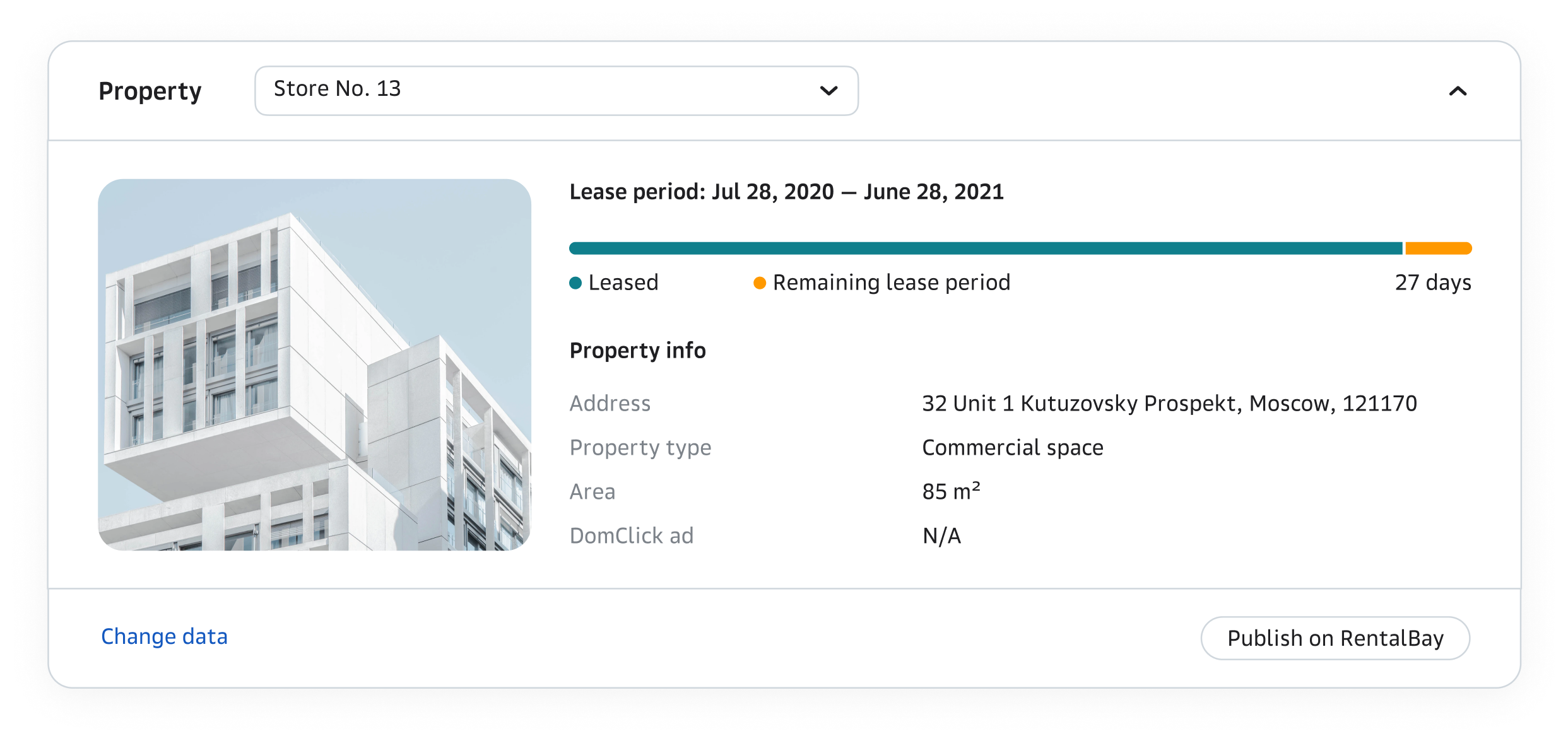

Property widget

Tenant settlements widget

The Property widget shows here-and-now facility details (including the lease term estimate) and allows publishing an ad on an external portal.

MOBILE

BANKING

BANKING

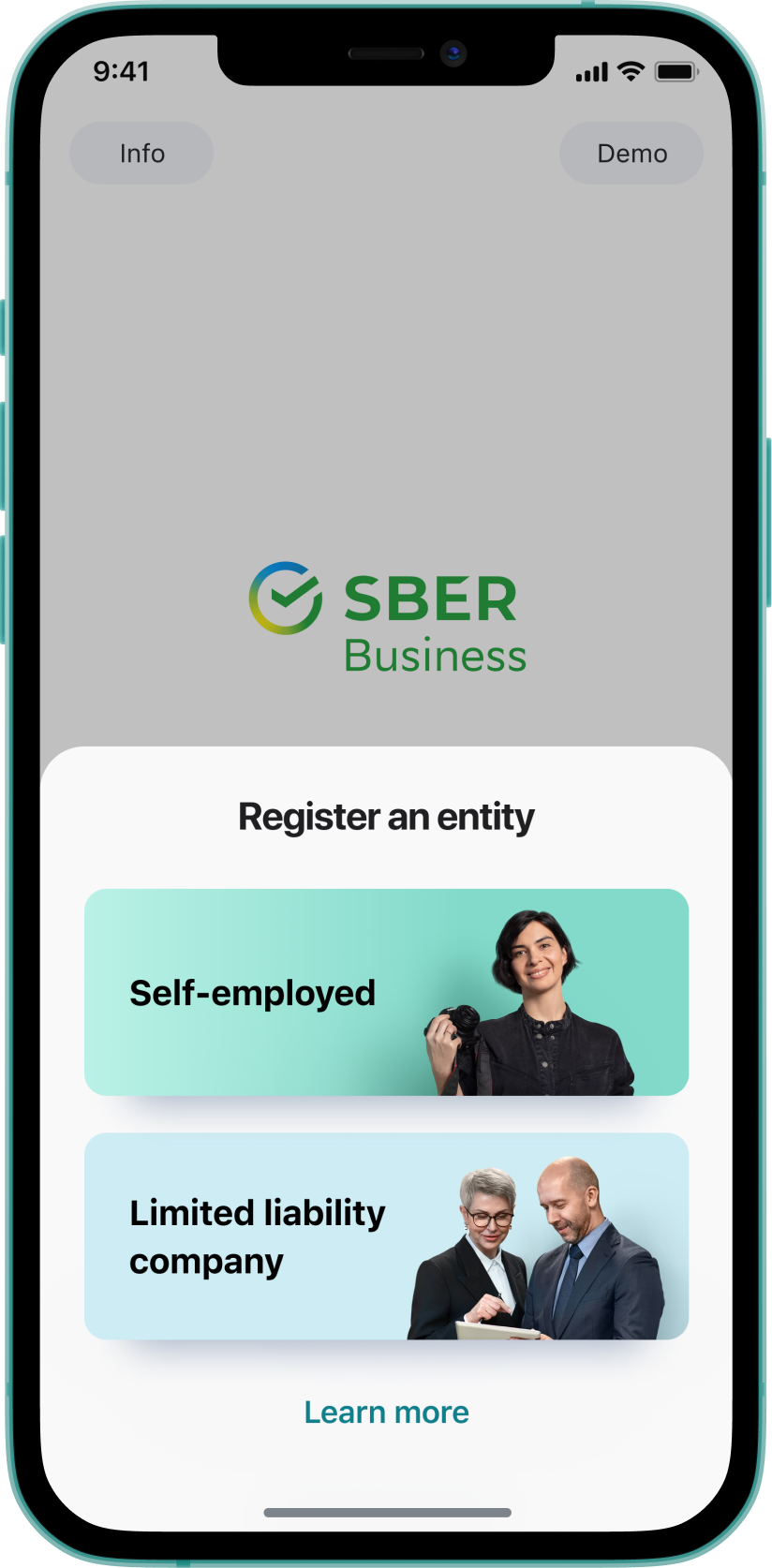

Simpler, faster and more mobile business with SberBusiness app

Since 2018, the corporate mobile banking audience has more than doubled and hit the 1-million mark.

A tremendous mindset shift brought by COVID-19 has hugely impacted the conservative corporate banking audience. Many of enterprise-level users have found themselves ready to use a mobile app as a primary—and sometimes the only—tool for managing their business. And we are ready to kit them out.

Today, SberBusiness app is a self-sufficient tool that helps corporate customers across all stages of their business lifecycle.

Today, SberBusiness app is a self-sufficient tool that helps corporate customers across all stages of their business lifecycle.

Starting new business

While many businesses didn’t make it during the pandemic, others used the chance and started all over again. With our mobile app, users can open accounts and register companies.

Managing things on-the-go

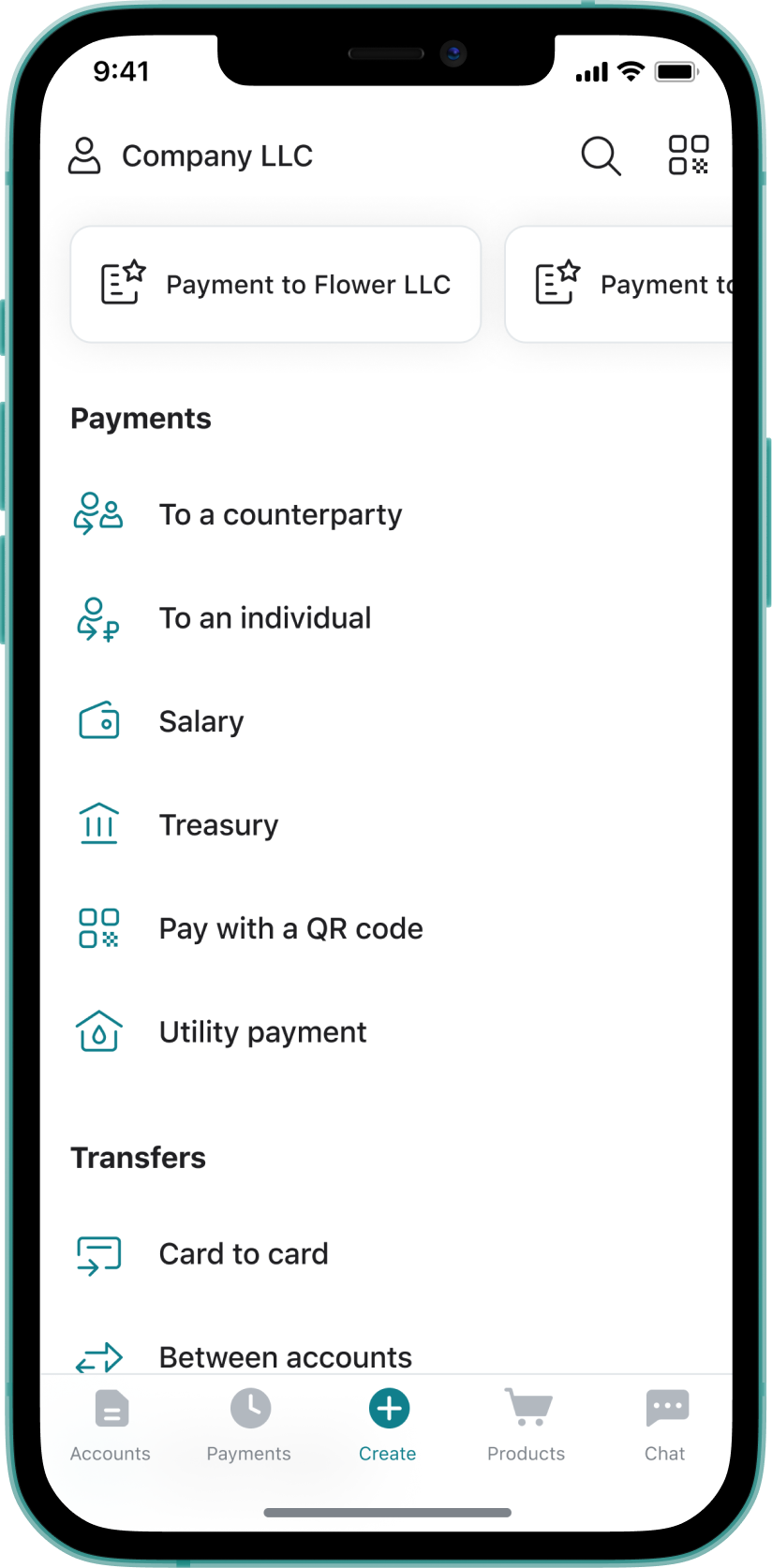

Convenient payments & transfers

• By account number, card number, and telephone number

• Biometrics + cloud signature for confirmation

• QR recognition from a file

• Payment revocation

• Automatic counterparty check

• Salary

• FX

• Biometrics + cloud signature for confirmation

• QR recognition from a file

• Payment revocation

• Automatic counterparty check

• Salary

• FX

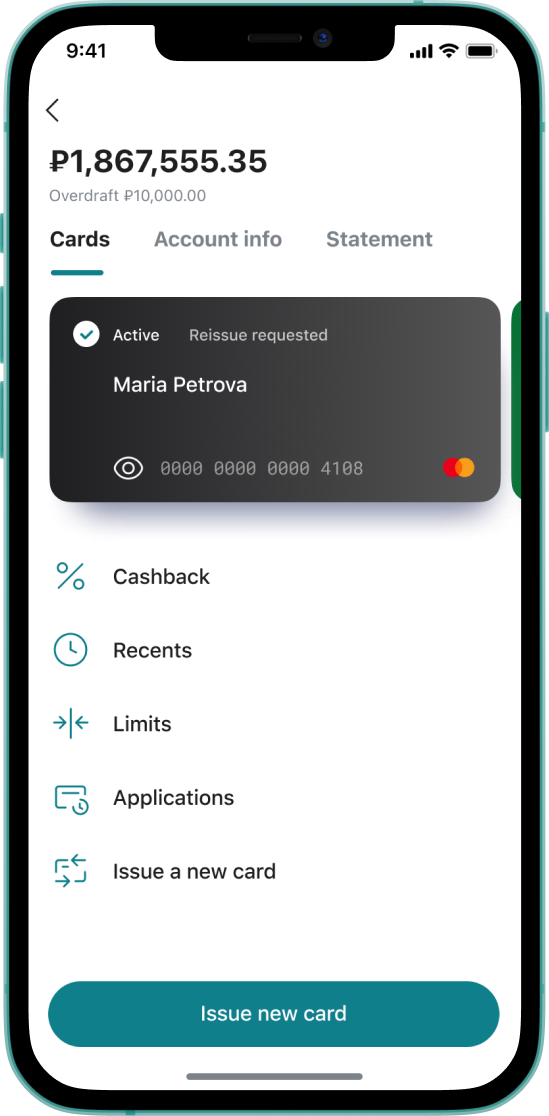

Corporate cards

• Digital and plastic card issue

• Courier delivery of plastic cards

• Viewing card number and CVV

• PIN change

• Limits

• Business cashback

• Courier delivery of plastic cards

• Viewing card number and CVV

• PIN change

• Limits

• Business cashback

Risk management

• Compliance request notifications

• Responding to compliance requests & uploading documents

• Risk mitigation tips

• 'Risk of account blocking' service

• Responding to compliance requests & uploading documents

• Risk mitigation tips

• 'Risk of account blocking' service

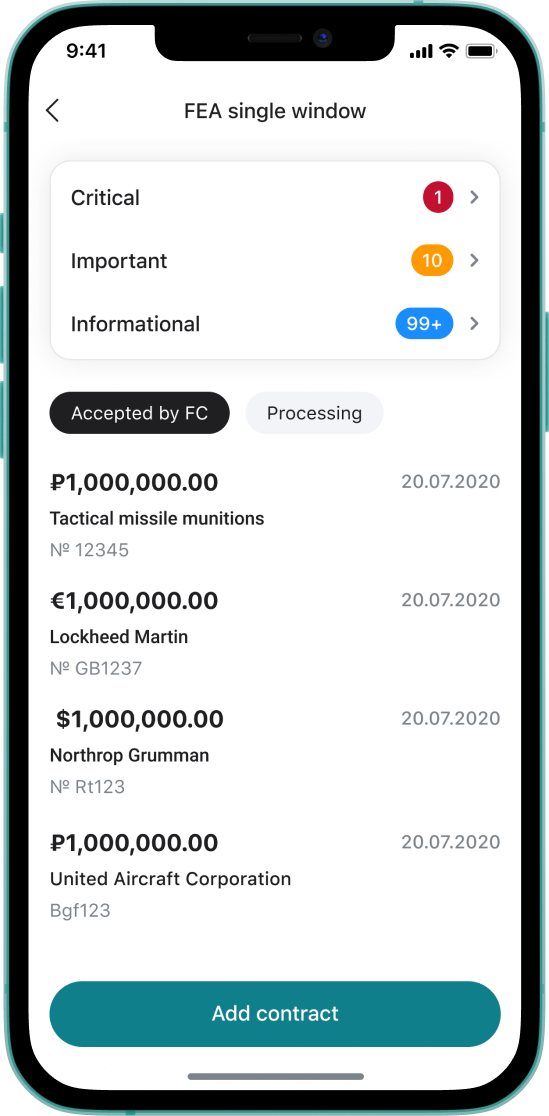

FEA

• Contract dashboard

• Sending contracts to forex controls

• Access to professional FEA consulting

• Sending contracts to forex controls

• Access to professional FEA consulting

Developing business

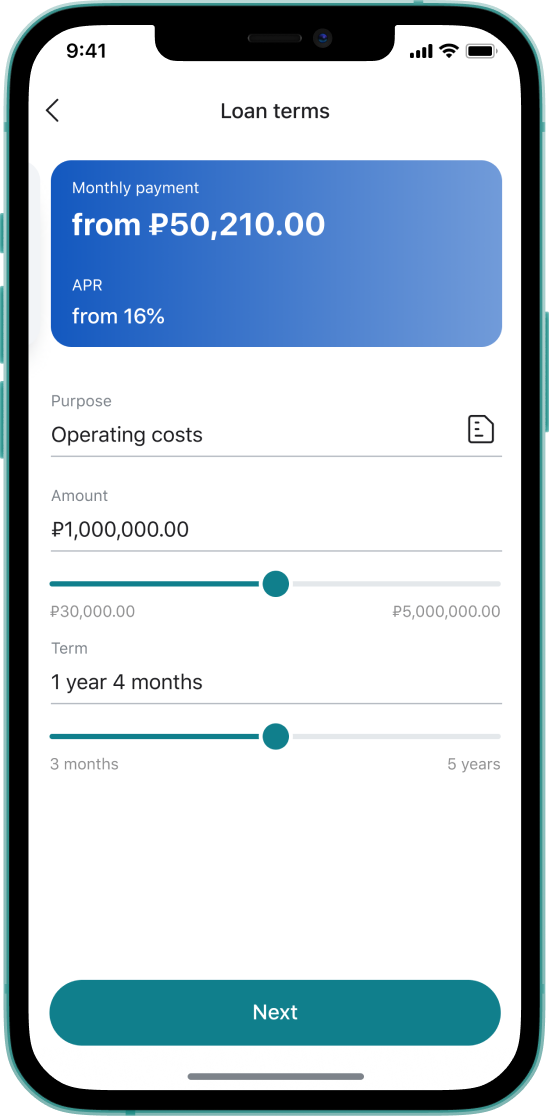

Smart-loans in mobile app

Starting from March 2021, SME customers can apply for a loan using the mobile app. All the steps—from submitting an application, to finding the funds credited to the account—take a few minutes: the entire process is online and requires no paperwork or visits to a bank office.

Inclusive marketplace of AI-powered services

In 2020 we launched Marketplace of services in the mobile app. All services are offered in Stories (like those on Instagram) with smart targeting, based on customer’s data and activity with the help of ML. Services, including Online Accounting, Lawyer for Business, Online Business Promotion, Corporate Taxi and other ones, are now available on the marketplace. To date, the store comprises 23 services.

Most of these features are available in the chat with voice assistant

In the mobile web version...

...and in Dark Theme, first in the Russian corporate banking application market

INTEGRATED

CORPORATE SITE

CORPORATE SITE

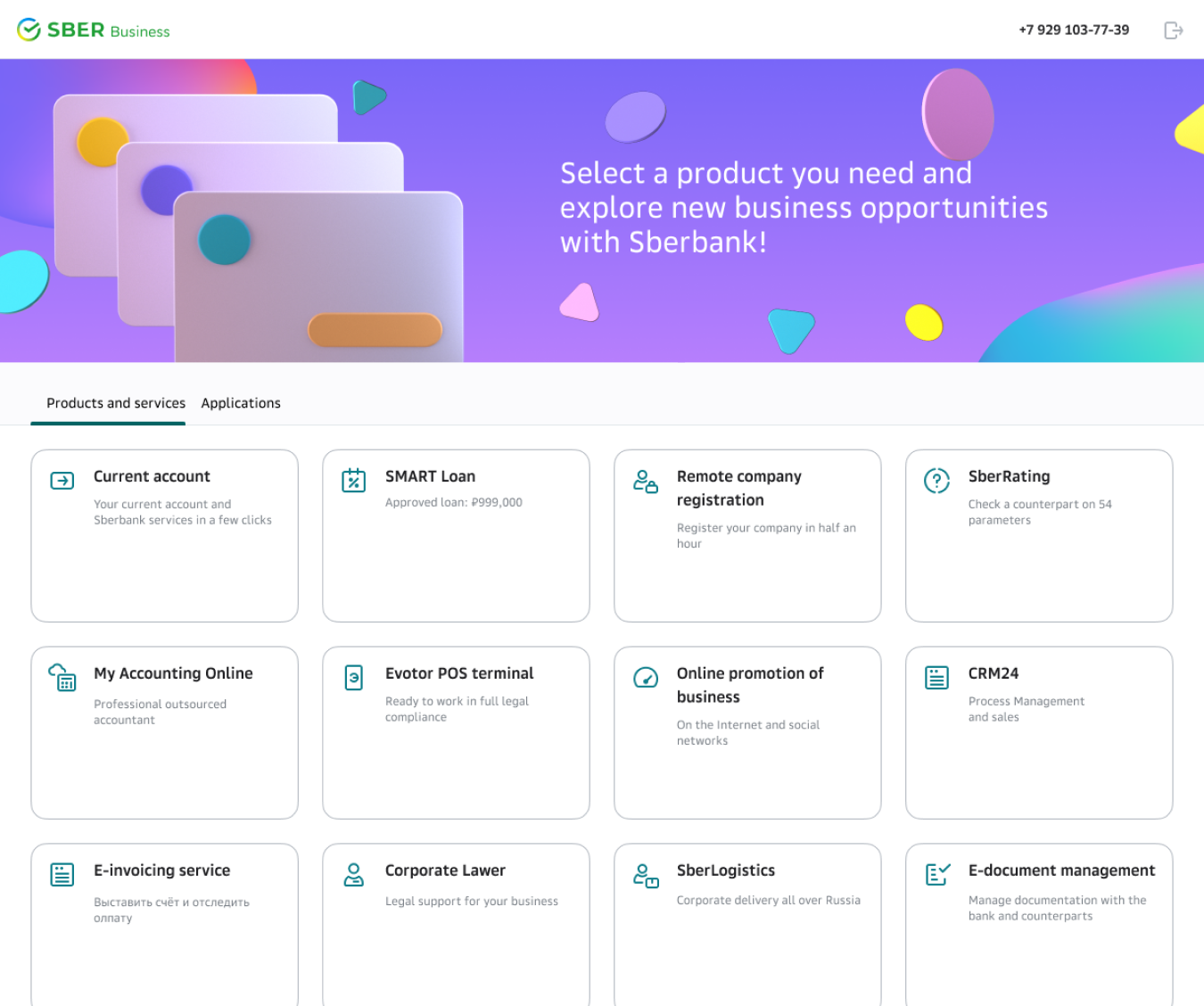

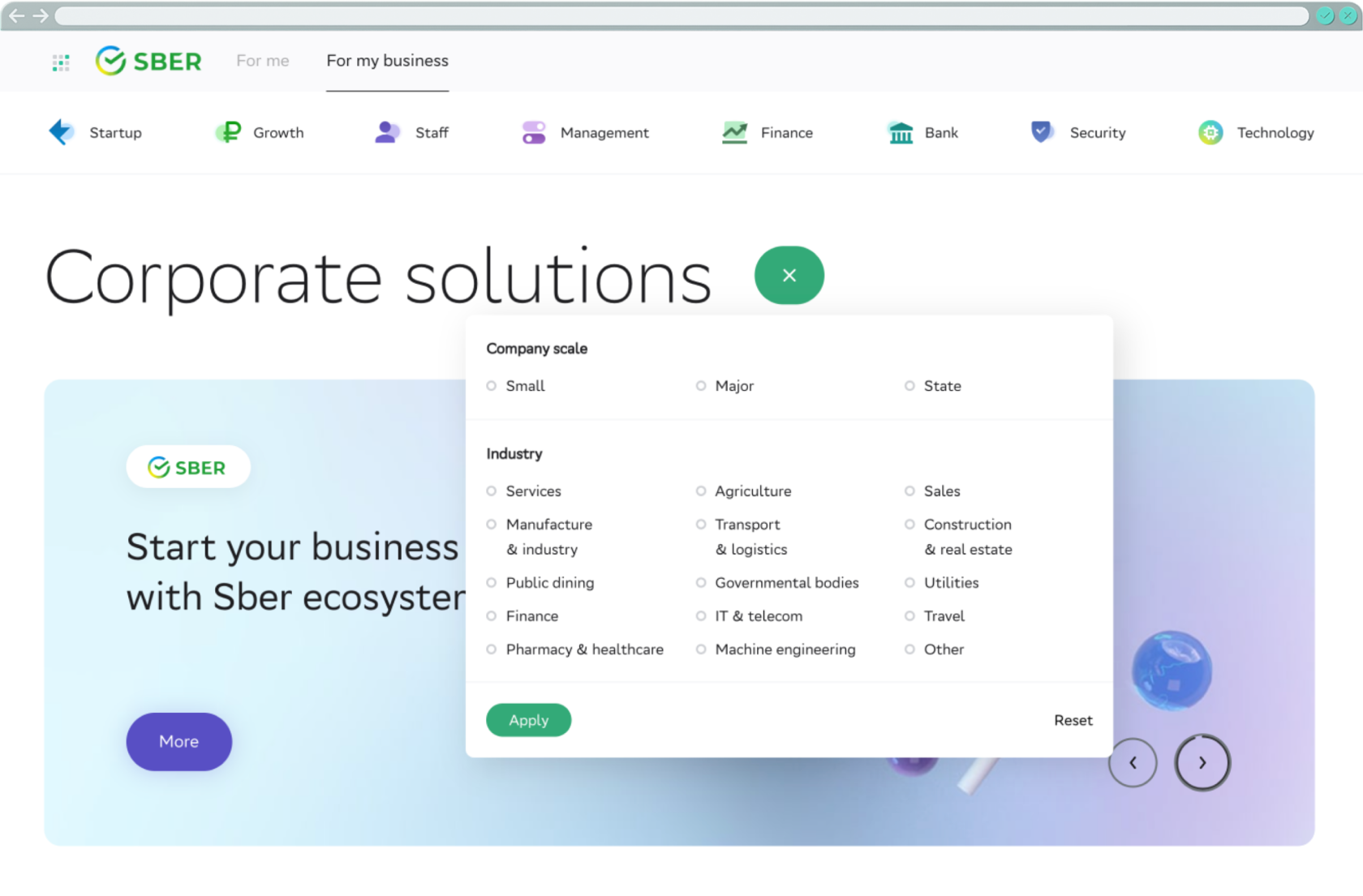

A single entry point to the extensive ecosystem of products, technologies and partners of Sber

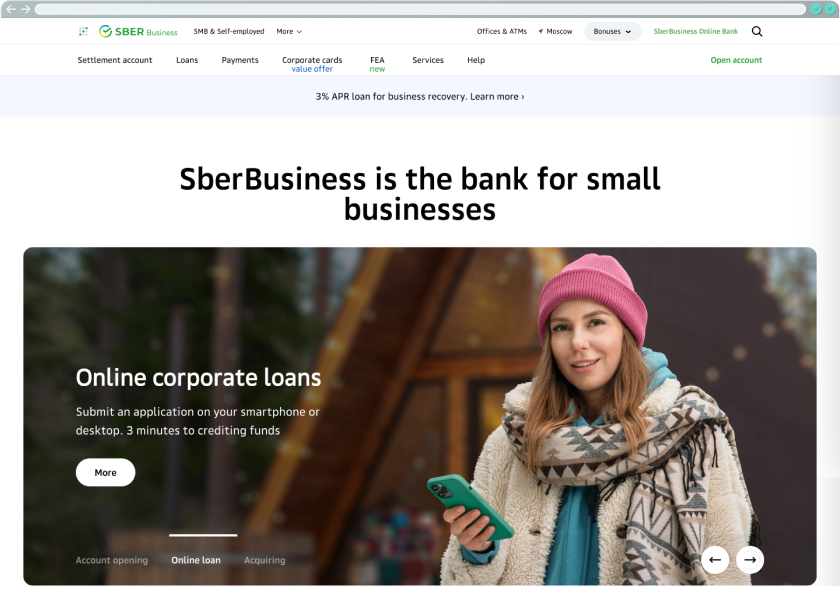

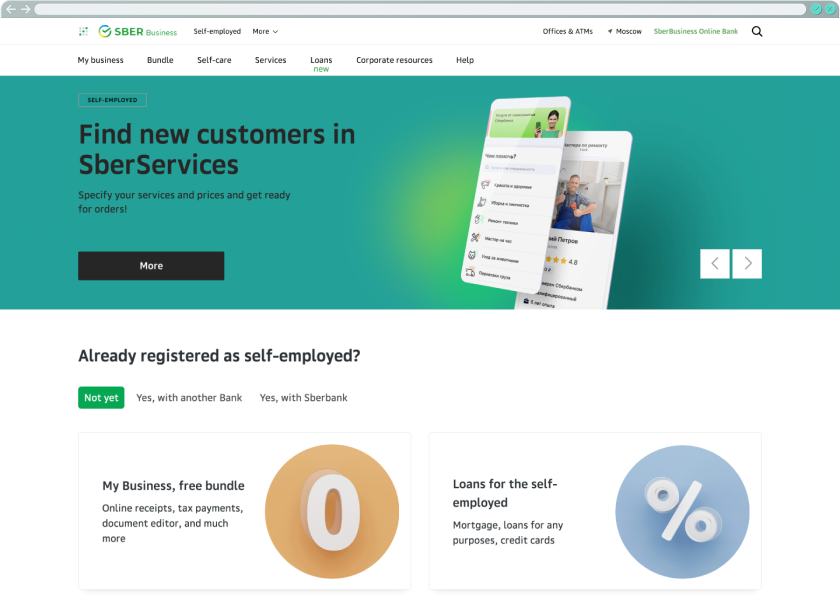

Along with a major rebranding that took place in Septemper 2020, sberbank.ru website got its new visual identity. The brand-new navigation logic and product grouping principle—all tailored to customer segments—guide users directly to the information they need.

SME

Self-employed

Corporations

Self-employed

The revamped section for the self-employed turned into a portal with comprehensive information for those who are ready to start their own business. Entrepreneurs can find tutorials, tips, helpful bank services, knowledge bases, professional recommendations, and many more.

Service bundles

No visits to the bank needed for starting business as a self-employed. Handy service bundles selector and distant account opening.

Video tutorials

Users enjoy step-by-step video tutorials on starting and growing a business: from registration and payment acceptance, to taxation specifics and external platforms to promote your services.

Digital services

Helpful digital services to streamline business routine for the self-employed.

SME

In 2020, the SME section met a new design system and visual language. We redesigned the section structure to help SME owners navigate across banking and ecosystem products. State support loans and credits were the primary focus over the crisis.

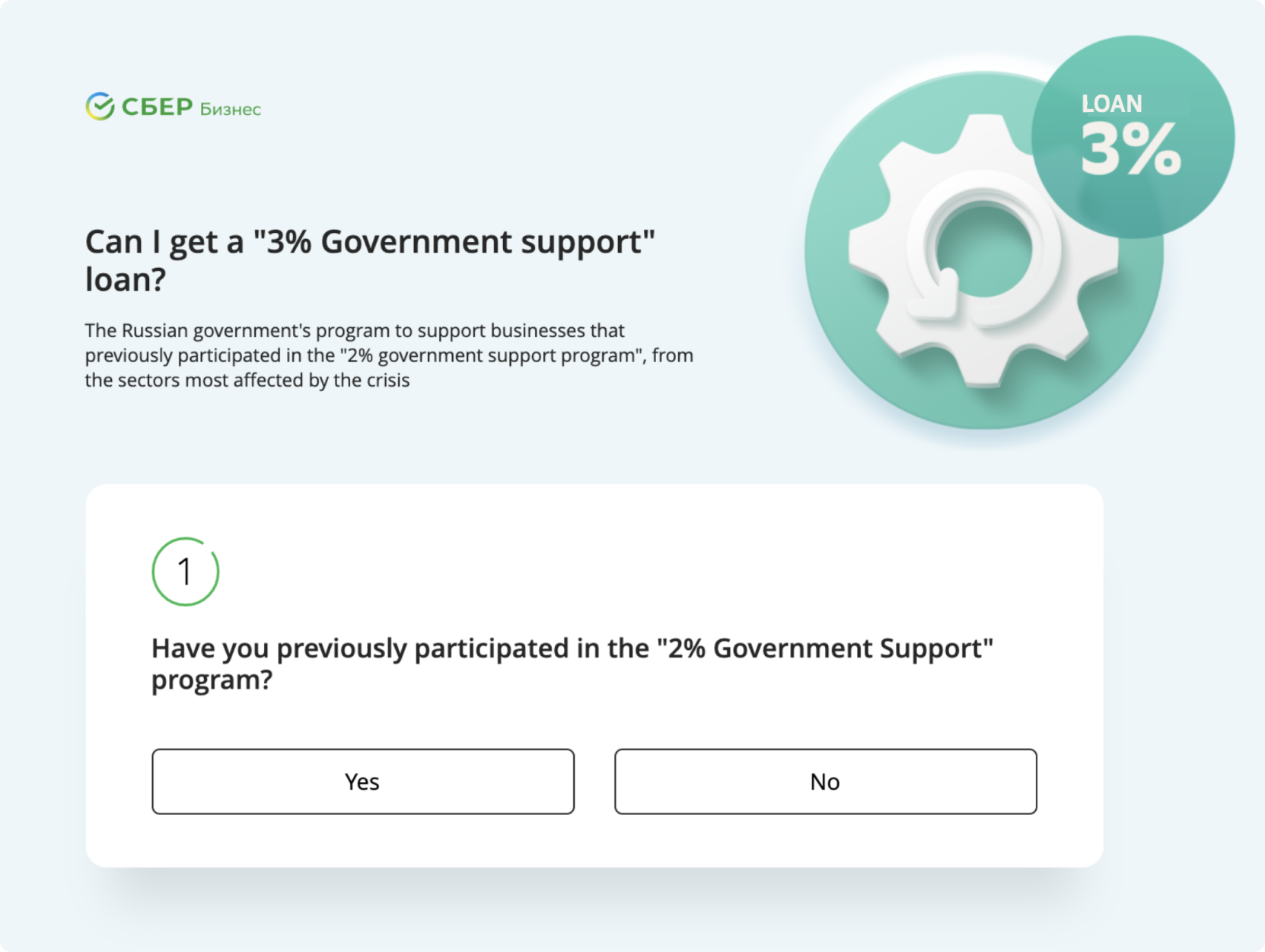

State SME Credit Support Eligibility Checklists

Online Checklists to define whether a company is eligible for the governmental SME credit support.

Fast call-back

We call back in a few minutes and arrange couriers for account opening.

Account reservation

The user can see the account details right after filling out a short account reservation form.

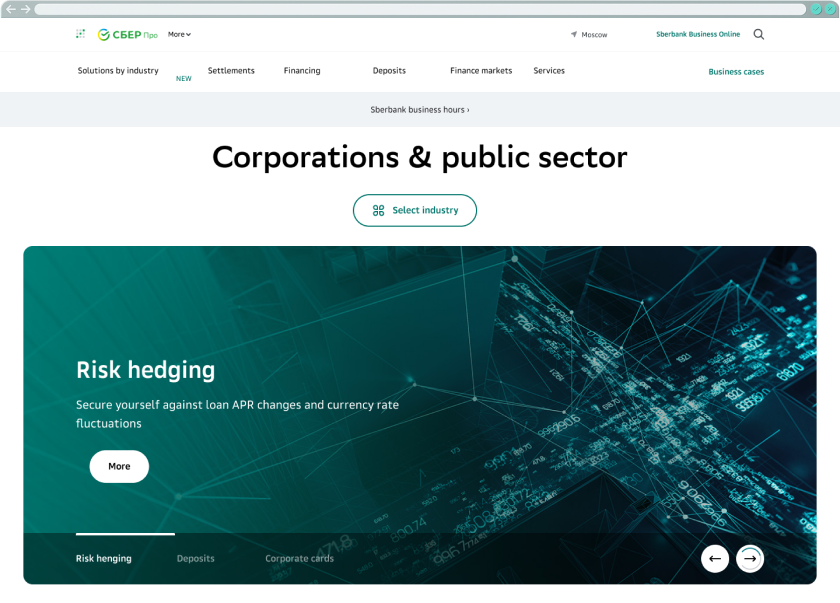

Corporations

In 2021, this section was refurbished and turned into an effective tool for addressing various and complex challenges of the corporate sector.

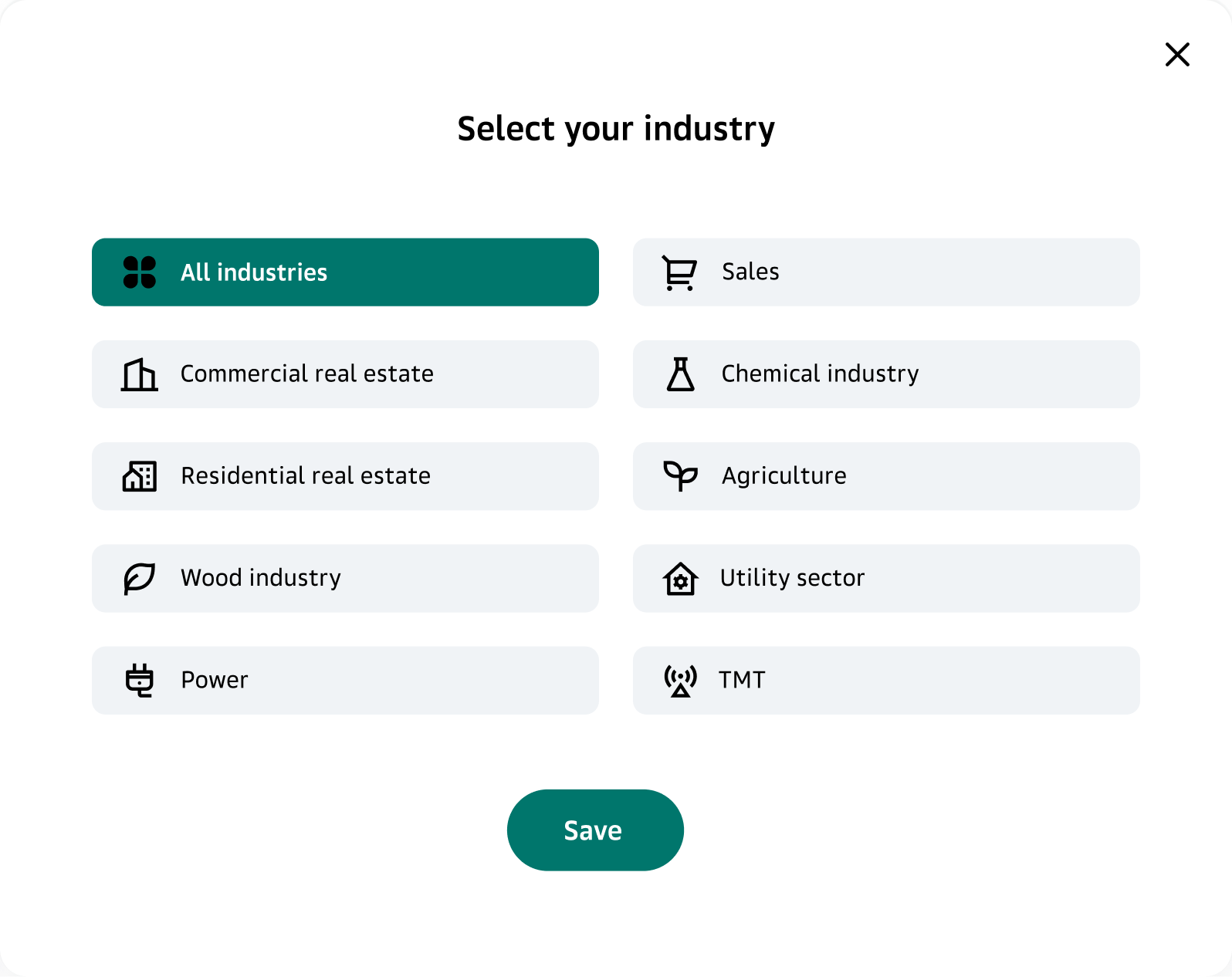

Industry selection

The content of the section transforms completely depending on the chosen industry. Users view only relevant content and product offers.

Online application

Online application for banking products is now available for corporate customers: loans, investments, payroll programs, CIT, leasing, bank guarantees, and many more.

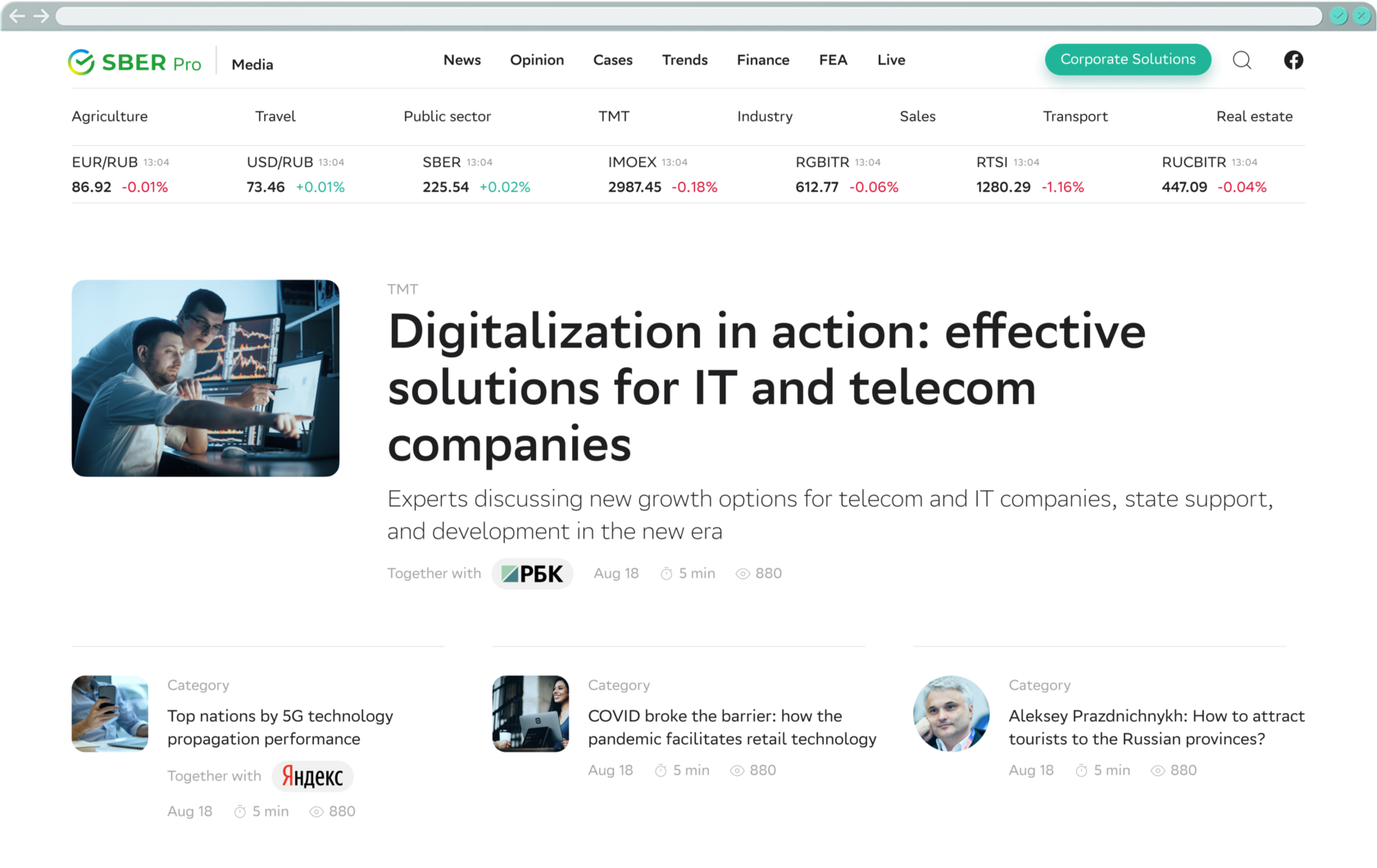

Customer acquisition through content

In March 2020, we launched SberPro Media a unique analytical portal that comprises functions of an industry media outlet and virtual conference media. The resource provides industry expertise, studies, latest news, and best practies from major world market professionals.

We also introduced a special section dedicated to the extensive range of ecosystem products and services for our corporate clients. There, a user can find a solution for a certain life cycle stage, activity, or industry. For those who want to fuel their business with technological innovations we offer extensive information on our IT-solutions such as data management and pre-processing, cloud platforms, computer vision and machine learning, biometrics etc.

Viber

Multi-language support

Maximum use of remote channels

WhatsApp

Online chat and chatbot

Video call

Big data-inspired personal bonuses and product offerings

SberLocals is a joint effort of Sber and Mastercard to support small businesses during tough times of the pandemic. SberLocals draws people's attention to local entrepreneurs in their city and encourages them to buy from them. This is a project for entrepreneurs and individuals. All entrepreneurs who have joined the project are marked on a map: www.sberbank.ru/sberryadom.

Potential customers see the companies on the map (on the Sberbank website and 2GIS maps) and buy goods and services from them. If they pay with their MasterCard issued with Sberbank, they will receive higher—up to 10%—bonuses from Sber. The more purchases, the more support a company receives.

Potential customers see the companies on the map (on the Sberbank website and 2GIS maps) and buy goods and services from them. If they pay with their MasterCard issued with Sberbank, they will receive higher—up to 10%—bonuses from Sber. The more purchases, the more support a company receives.

Movement in Support

of Small Businesses

of Small Businesses

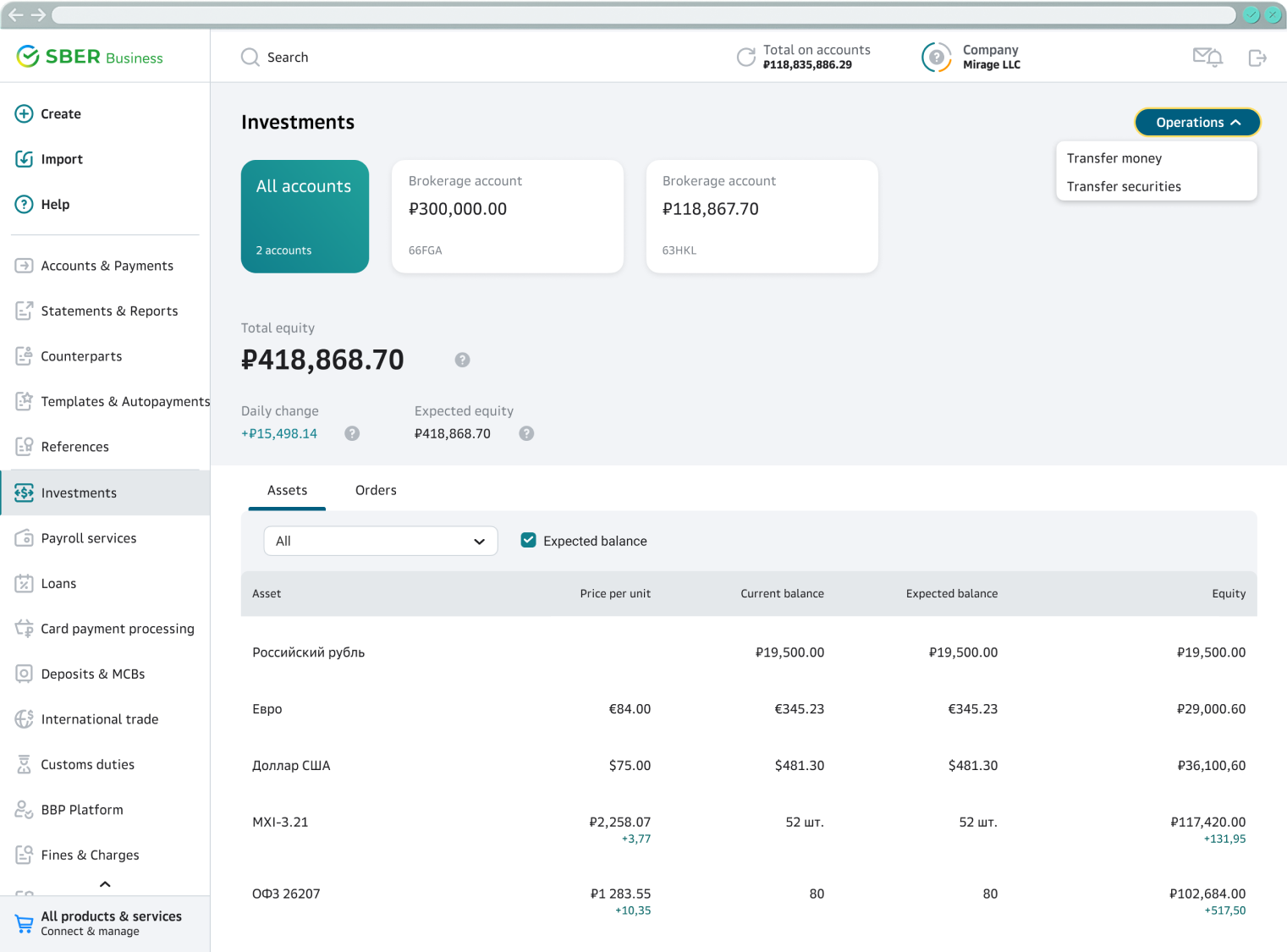

ONLINE INVESTMENT SERVICES

One-click trading strategy

Mass users

• Updated depository functionality

• Currency transfers to the brokerage account

• Bond payment calendar: disbursements against bonds the client holds

• 24/7 up-to-date client portfolio balances (stock, forex, OTC markets).

• Currency transfers to the brokerage account

• Bond payment calendar: disbursements against bonds the client holds

• 24/7 up-to-date client portfolio balances (stock, forex, OTC markets).

We offer affordable digital investment tools for the mass business segment, integrated into the web-bank. The Investments section in SberBusiness web bank was launched in spring 2020. Here corporate customers can open brokerage account. Since then we added new features such as:

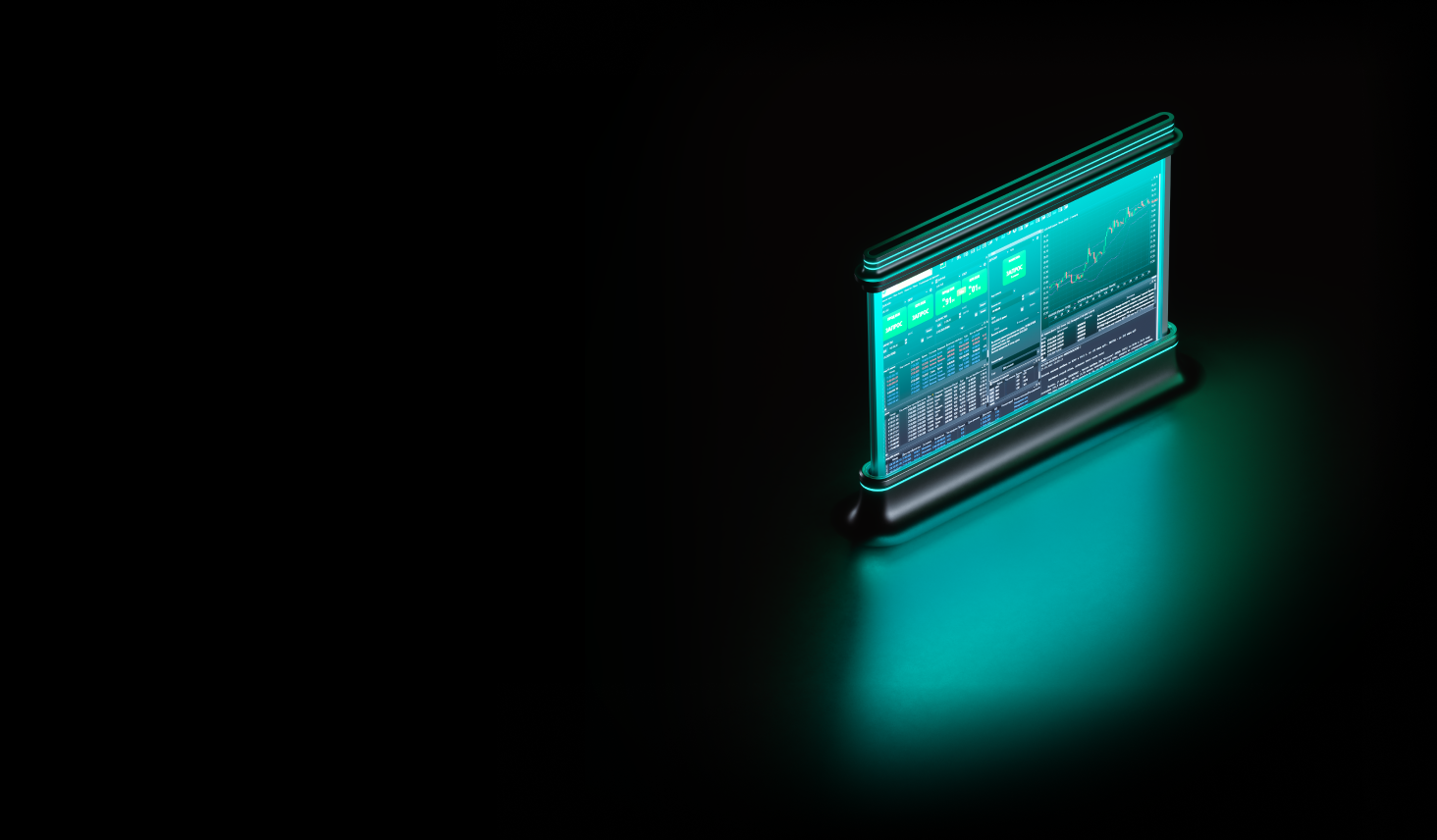

Advanced users

For our advanced users we continued developing proprietary platform, SberCIB Terminal, which was employed by 4,000 corporations and banks.

The customers are offered conversions with 35 currency pairs, transactions with currency derivatives and precious metals, deposits and minimum balance agreements, and also brokerage products. The hours of trading sessions have been extended the platform is now open for making

transactions 20/5.

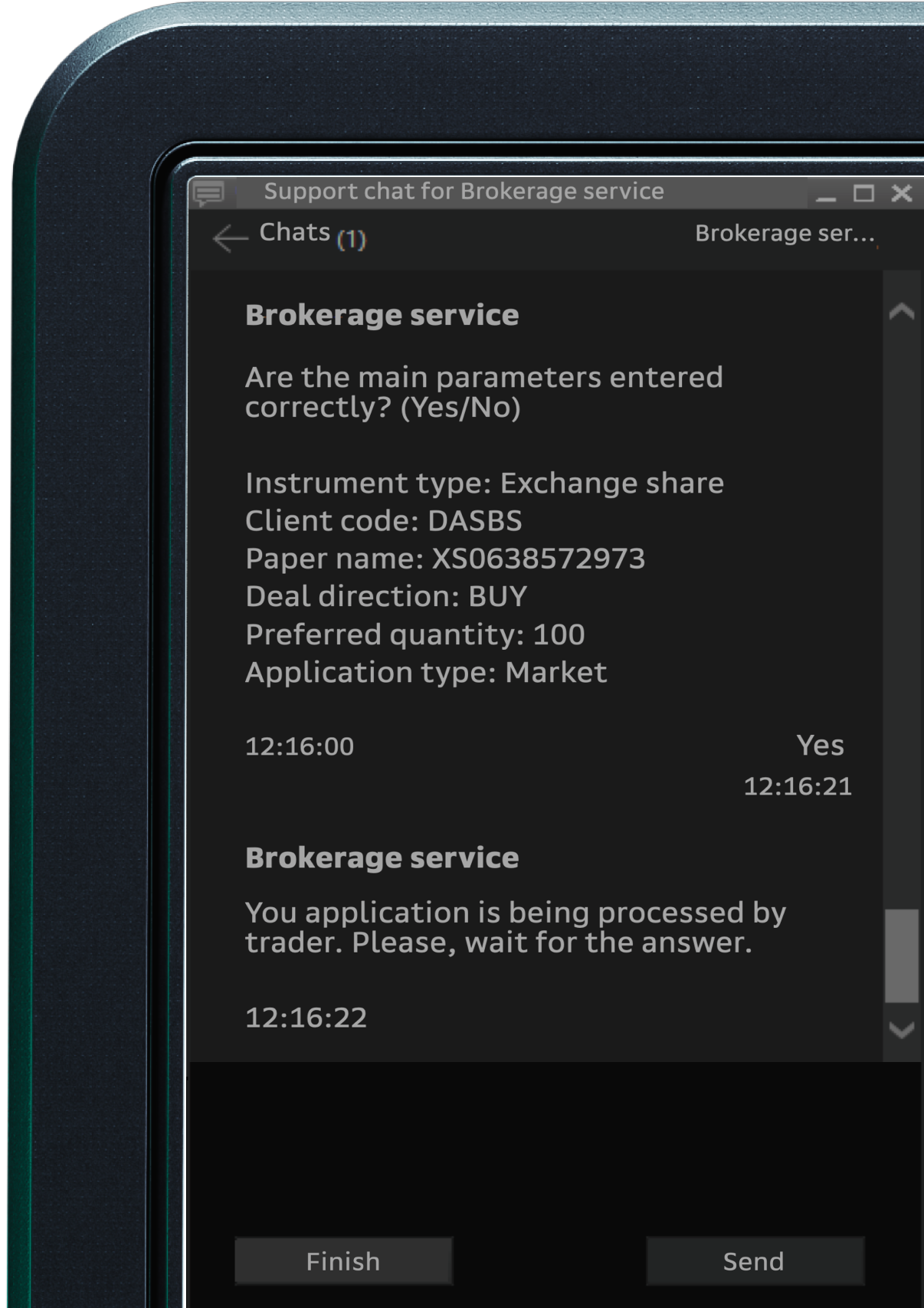

We also offer unique sales-assistant technology via chat-bot. It collects clients’ requests on brokerage trades and assists Sberbank employees to process such transactions directly in chat.

The customers are offered conversions with 35 currency pairs, transactions with currency derivatives and precious metals, deposits and minimum balance agreements, and also brokerage products. The hours of trading sessions have been extended the platform is now open for making

transactions 20/5.

We also offer unique sales-assistant technology via chat-bot. It collects clients’ requests on brokerage trades and assists Sberbank employees to process such transactions directly in chat.

ONLINE CASH MANAGEMENT

An unexpected live test of bank's resilience in COVID-19 times

We are proud of our achievements in the development of payment infrastructure in 2020, omnichannel approach, speed of payments and their availability 24/7, which significantly supported our customers in the pandemic:

Now even fewer reasons to visit the branch

Remote business registration and account opening

• Takes less than 20 minutes

• Only 3 documents and smartphone with NFC needed

• At any time with no visit to Federal Tax Service

• 11% share of all business registrations in Russia in 2020.

• Only 3 documents and smartphone with NFC needed

• At any time with no visit to Federal Tax Service

• 11% share of all business registrations in Russia in 2020.

100% digitalization of corporate debit cards

In February 2021, we launched 'Plastic as an option' project. Now when issuing any debit card, business customer chooses the format: digital or plastic. By May 2021 every fourth client prefers digital format.

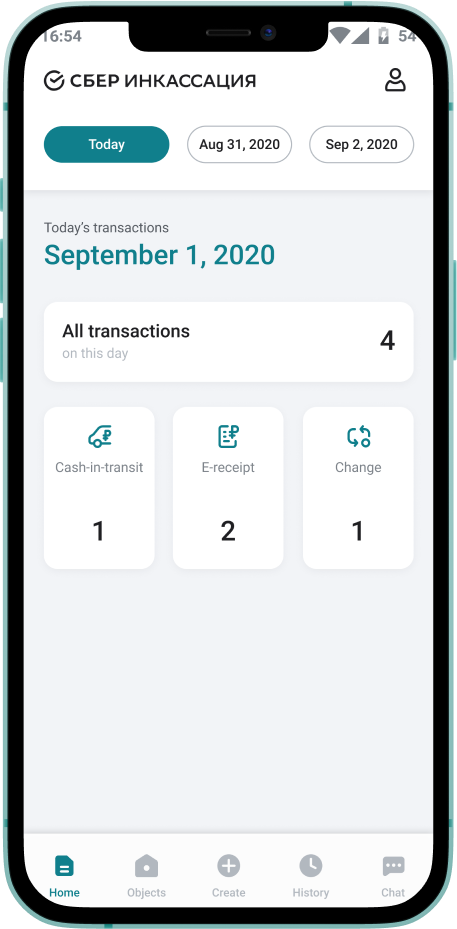

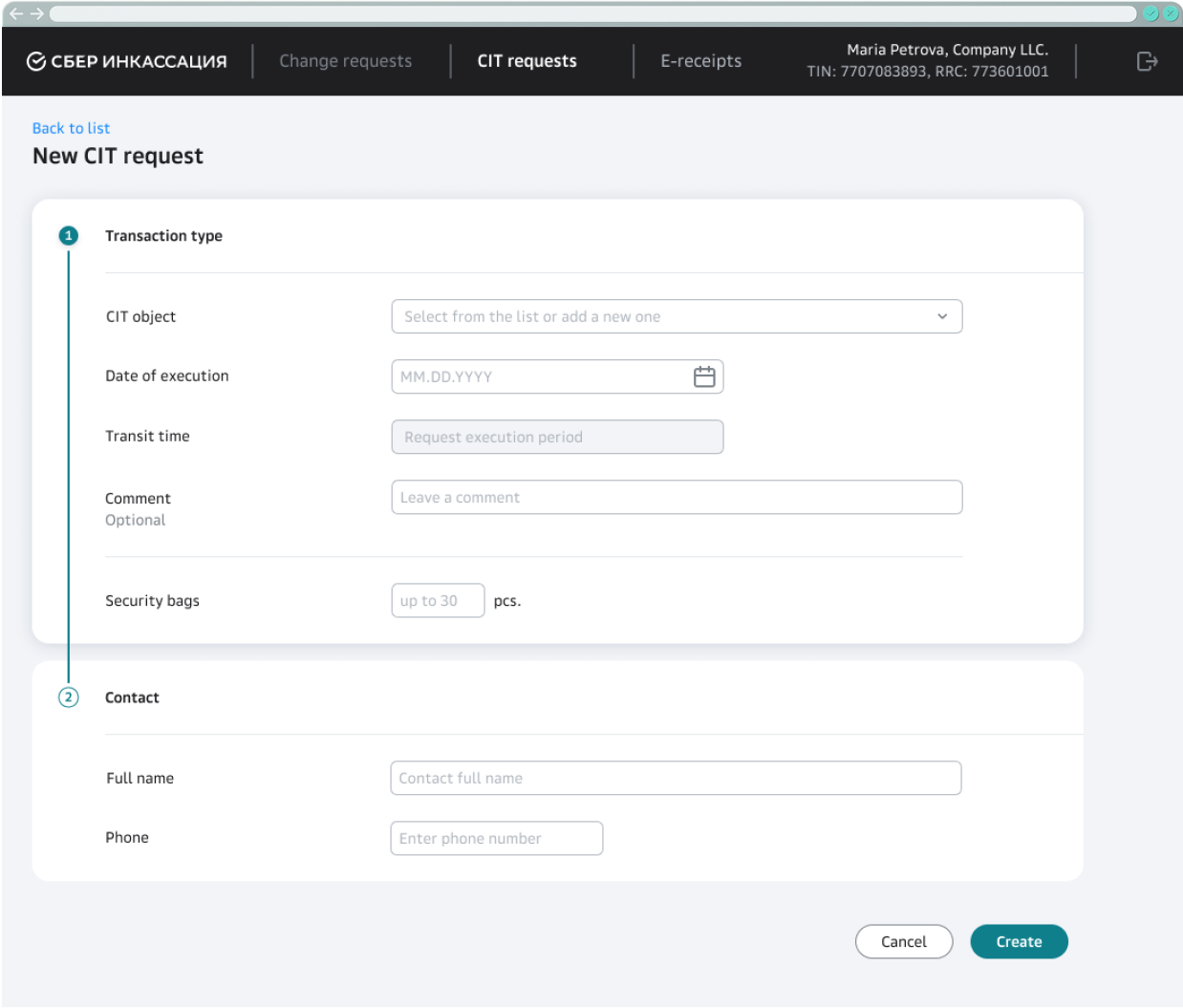

Digital cash-in-transit (CIT) services

Now available online 24/7 without calling the bank: submit and cancel requests for CIT, track the status of requests and security bags in transit, look up the schedule, prepare documents in electronic form.

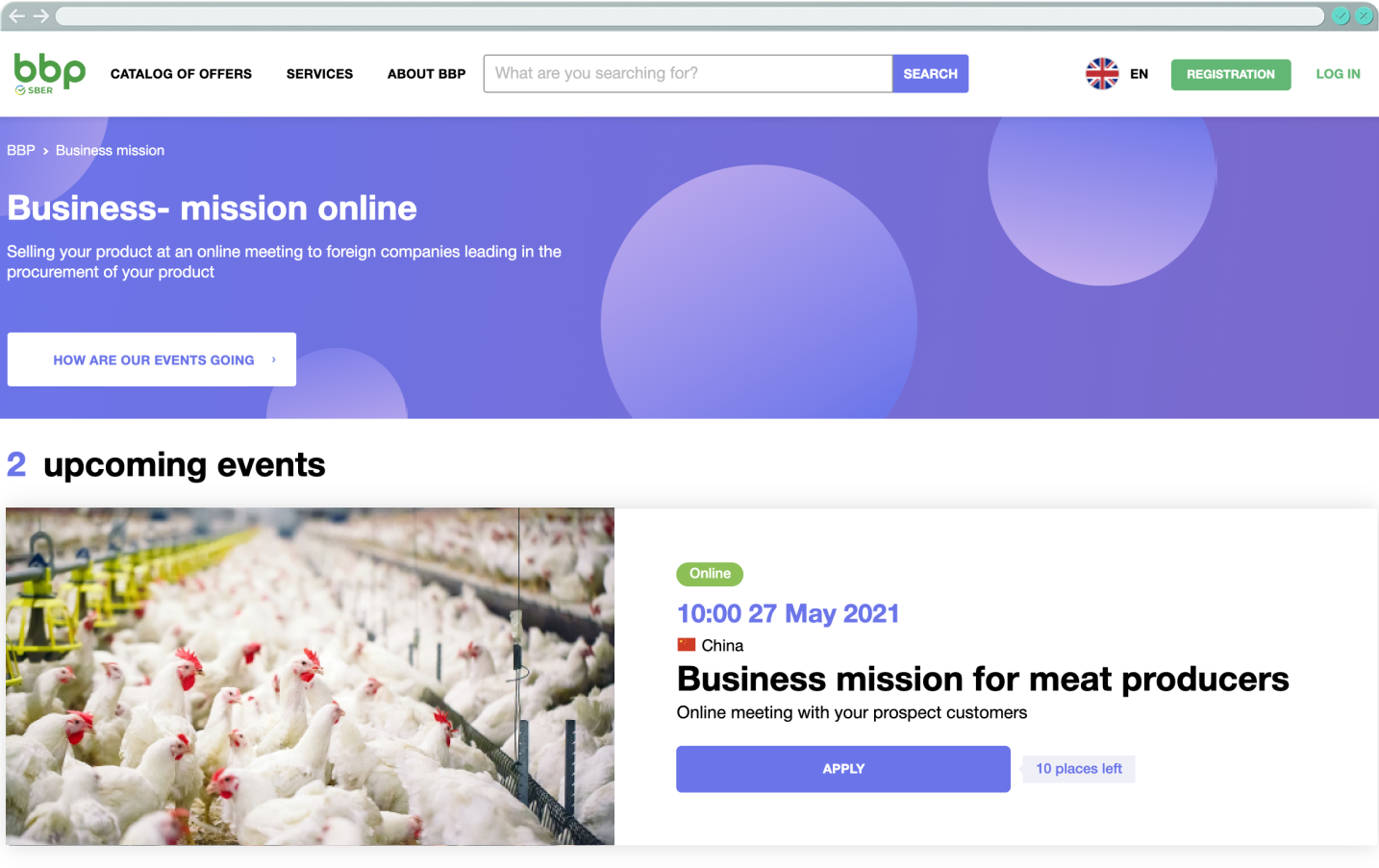

Online 'Business Mission' service

In May 2020 we launched the new service to replace industry-specific fairs and exhibitions, canceled due to the pandemic. Russian manufacturers present their products to foreign buyers, and each business mission is organized for a particular product in a particular country.

16 online business missions have been made with China, India, Kazakhstan, the Czech Republic, and Hungary. In total, over 650 companies from Russia and abroad were involved.

16 online business missions have been made with China, India, Kazakhstan, the Czech Republic, and Hungary. In total, over 650 companies from Russia and abroad were involved.

ONLINE TRADE SERVICES

Massive shift to digital

In 2020, Sber was named the best trade finance bank in Eastern Europe by Global Trade Review. For our customers we offer a unique and the most diverse range of digital functionality for trade financing on the market.

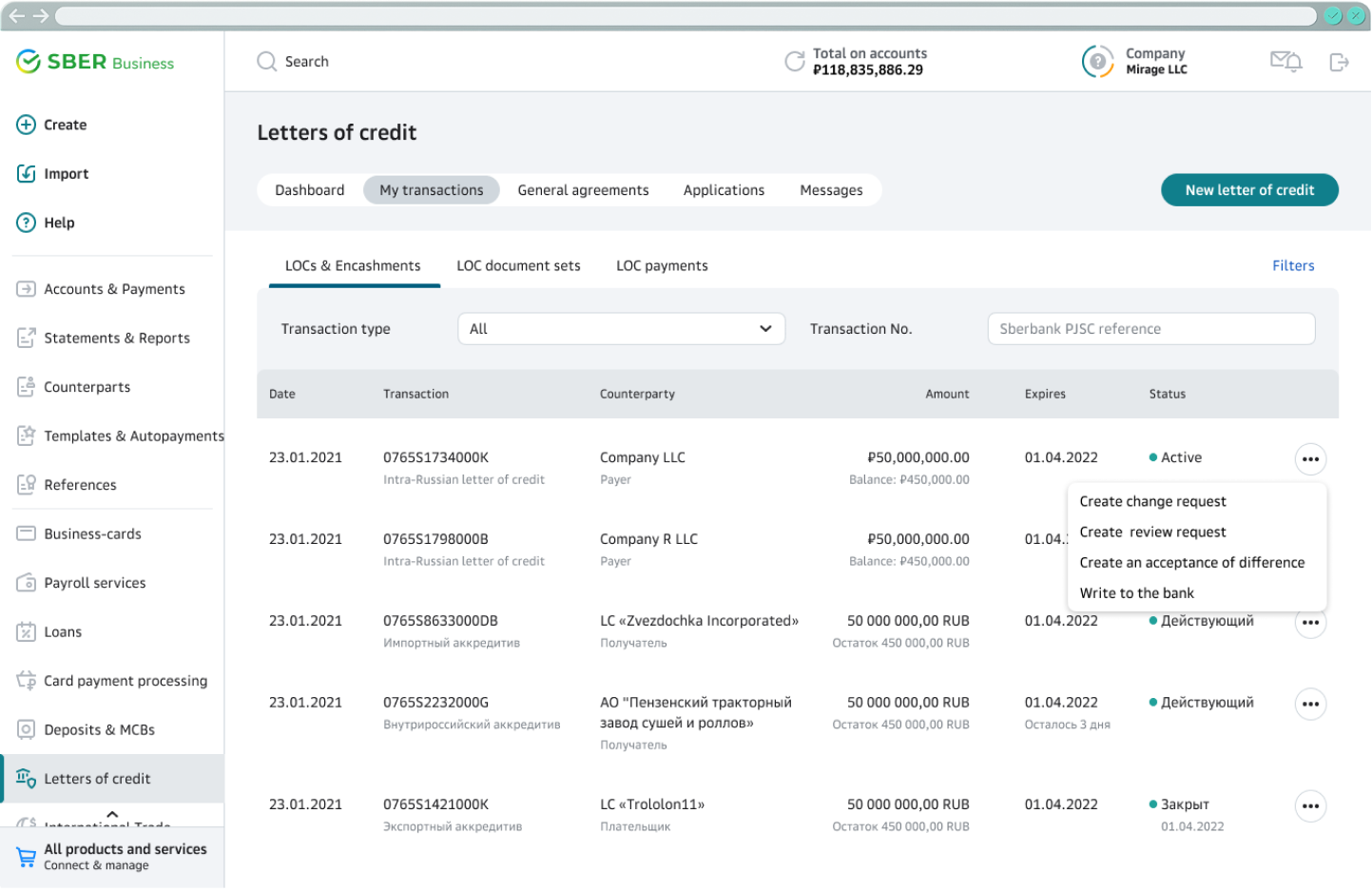

Letters of credit

For remote working with letters of credits we use a 'one-stop-shop' approach and keep upgrading the dedicated Letters of Credit section of our web bank. There, users can:

• Apply and submit letters of credit

• View real-time transaction data

• Interact remotely with the bank (letter of credit advising, discrepancy acceptance, etc.)

• View real-time transaction data

• Interact remotely with the bank (letter of credit advising, discrepancy acceptance, etc.)

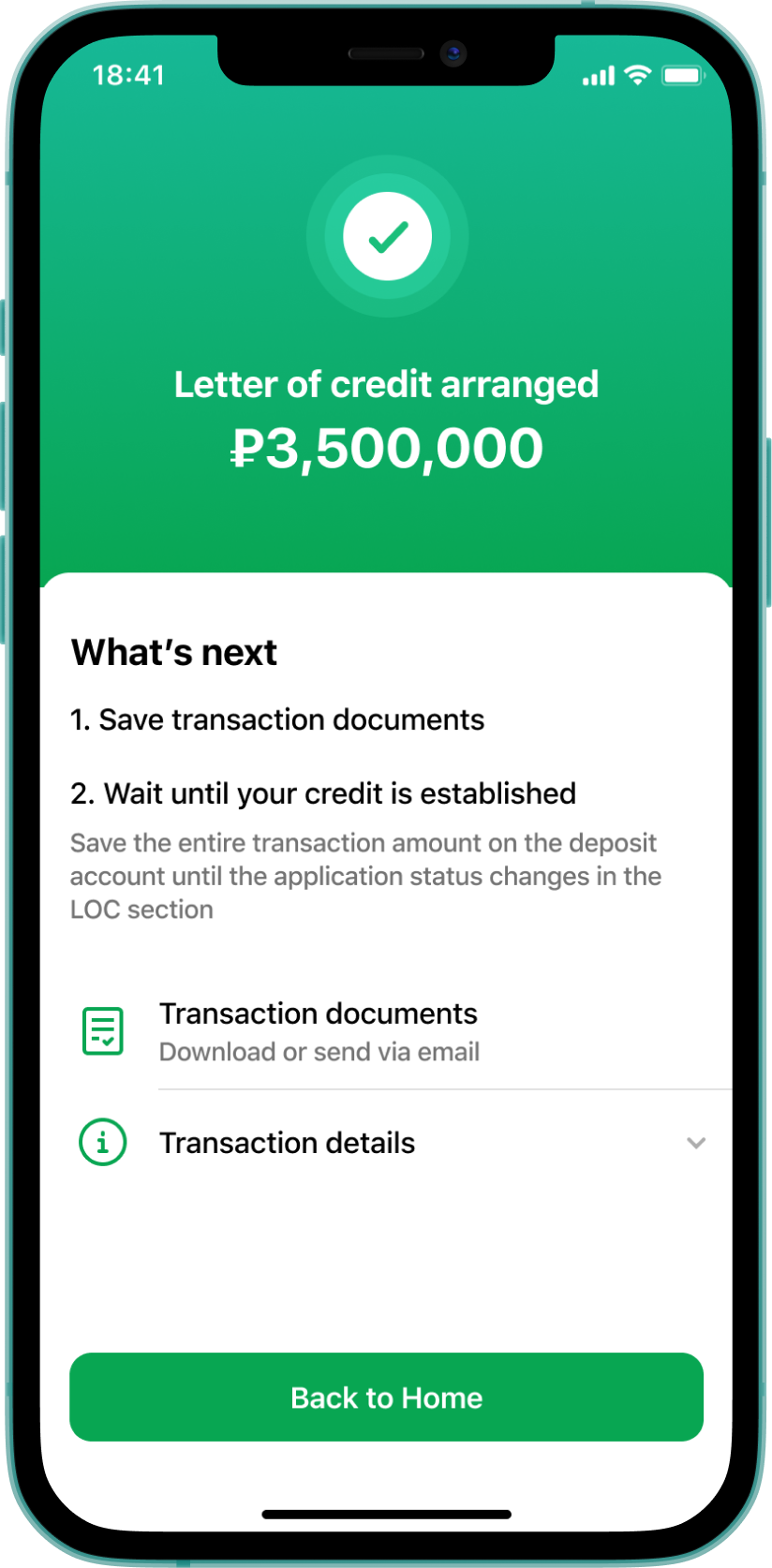

We also offer an unique service that helps individual customers issue a letter of credit in the SberBank Online mobile app.

In 2021, we introduced online LOC draft creation in Beneficiary’s ERP systems via API to enable the applicants to sign the application in the mobile app. It became Russia’s first online service of the kind.

Letters of credit API

As a result of this strategy by 2021:

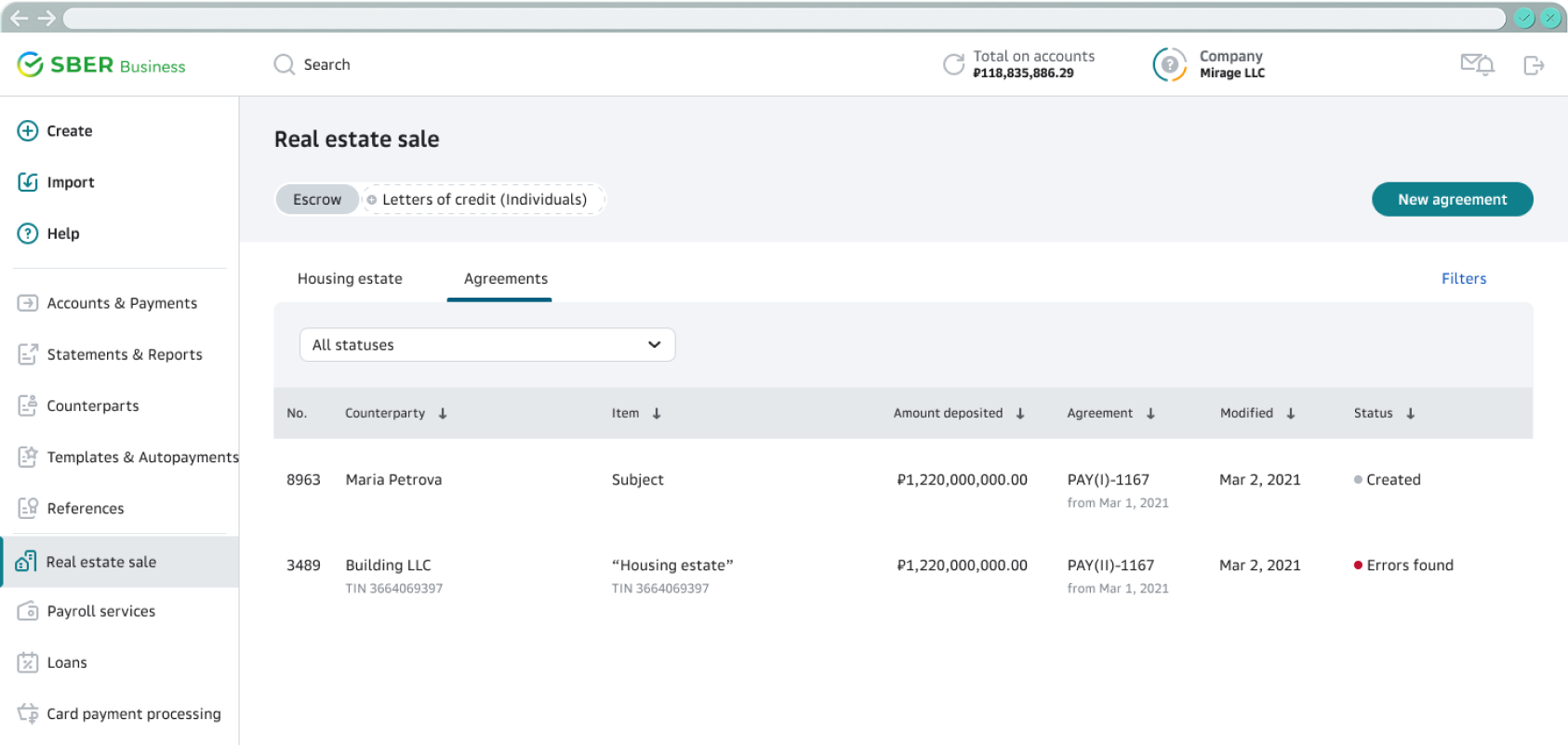

Escrow accounts

We also keep expanding the range of digital escrow services available in the SberBusiness online bank. This functionality is especially popular among real estate industry customers. Today, the web bank helps them:

• Create and sign electronic escrow account agreements and submit them to shareholders for signing in the mobile app, track escrow account agreement statuses

• Access all the information on the shareholder's account and current cash balances

• View real-time reports on escrow accounts

• Sign escrow account agreements in one click and remote account replenishment.

• Access all the information on the shareholder's account and current cash balances

• View real-time reports on escrow accounts

• Sign escrow account agreements in one click and remote account replenishment.

This option offers the same capabilities of working with escrow accounts (contract creation and signing, data showcasing, reporting) as the web bank’s online service, but in the customer’s CRM system via API.

Escrow Accounts API

Results of 2020-2021:

ONLINE

TREASURY

SERVICES

TREASURY

SERVICES

Innovative tools for corporate CX and risk management

In 2020, Sber added new algorithmic products to improve both customer service and the bank’s internal liquidity. We have implemented new access to major global platforms via API, and made many of digital treasury tools affordable for mass corporate segment.

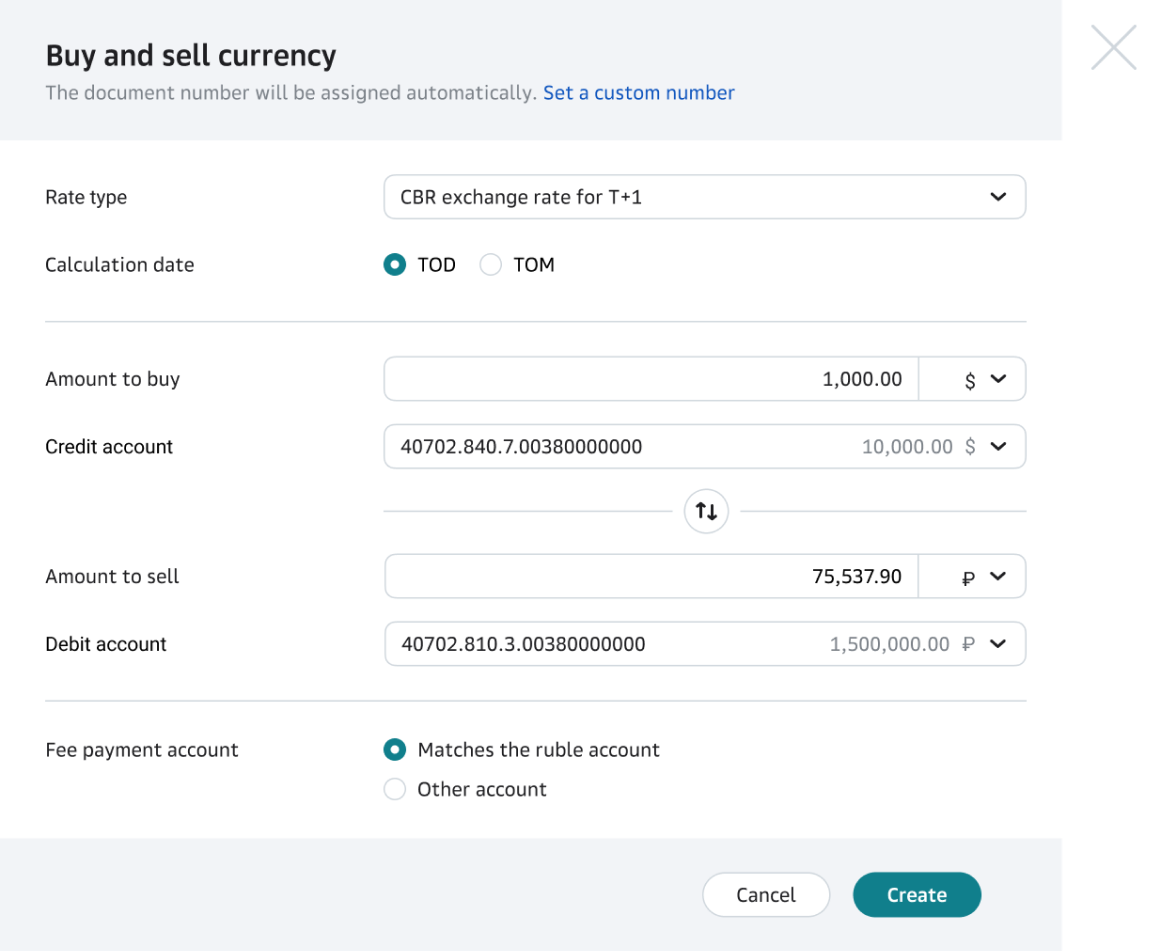

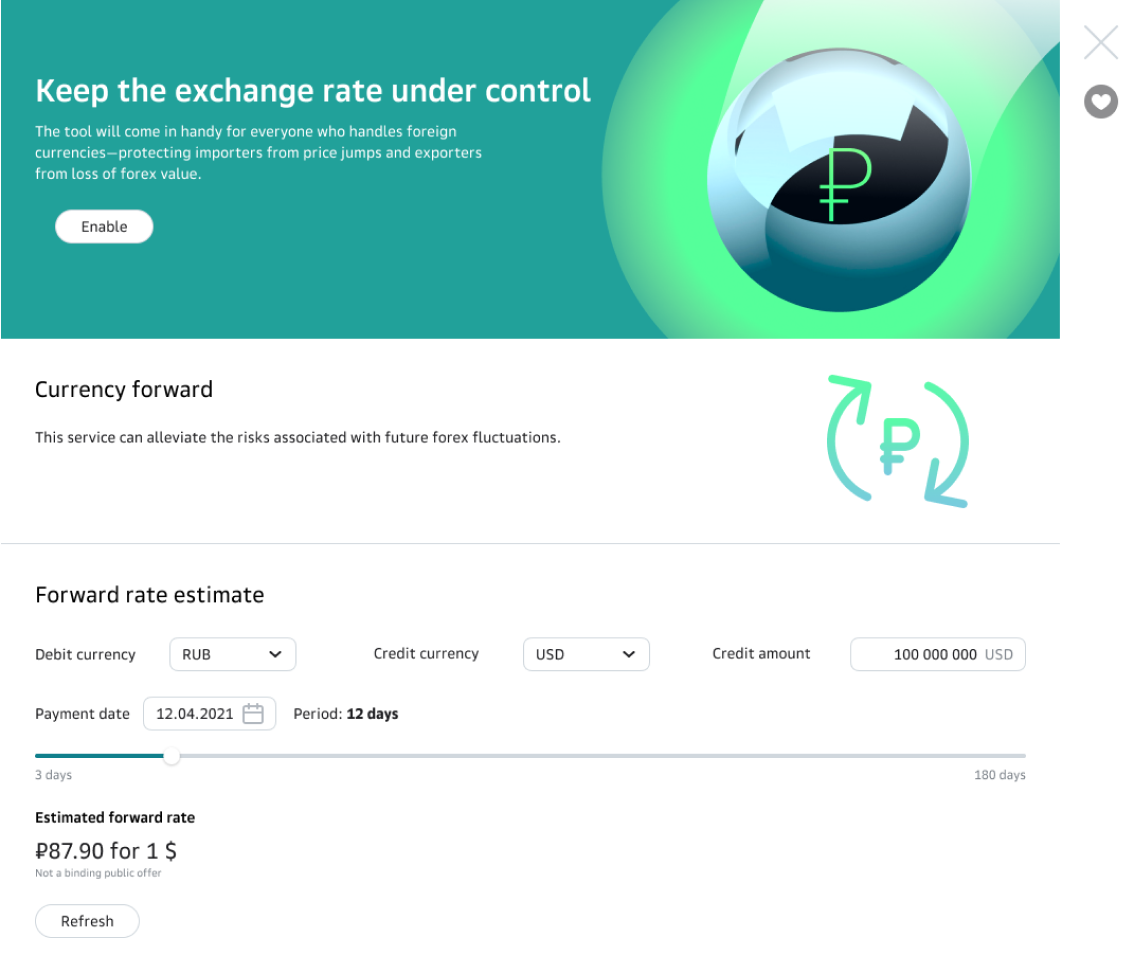

Transforming complex financial products into simple solutions for the mass segment in web-bank SberBusiness

New algorithmic products

In 2020 we added an algorithm that replicates execution at Russian Central Bank and currency exchange with payment deferment for our mass corporates. They can enjoy higher yields with FX rate-linked structured deposits.

Currency exchange with payment deferment

It allows to fix the FX rate in the moment and settle the trade in future, eg in a week. We are one of the first in Russia to grant mass customers a quick access to FX derivatives including unique electronic onboarding for Russian ISDA, simplified digital process for getting trading limit and genuine widget for trading.

Existing and future FX trading opportunities in web bank

We are now building a single interface in SberBusiness that will consolidate all existing and future FX trading opportunities (simple FX, CBR, derivatives) and the media content to address basic cases and explain how all our solutions can be seamlessly incorporated into day-to-day business. This is going to be a single portal on FX risk management tailored for mass, unadvanced users. We expect to launch the MVP version of such interface by the end of May 2021.

Bringing corporate treasuries to higher digital levels

Sber advanced customers enjoy tailored SberCIB Terminal, which supports FX conversion, FX swaps and forwards and non-deliverable forwards, deposits and precious metals.

In 2020 we added new orders to trade FX - limit order at the Central Bank FX rate, order that waits for the price till a certain date or till it’s cancelled, time-weighted average price and back-to-back trades.

Having the opportunity to export/import all data from the Terminal, customers can build FX payment calendar with the best price on precise dates. Another bonus point for digitization!

In 2020 we added new orders to trade FX - limit order at the Central Bank FX rate, order that waits for the price till a certain date or till it’s cancelled, time-weighted average price and back-to-back trades.

Having the opportunity to export/import all data from the Terminal, customers can build FX payment calendar with the best price on precise dates. Another bonus point for digitization!

Providing Trading-as-a-Service to institutional clients

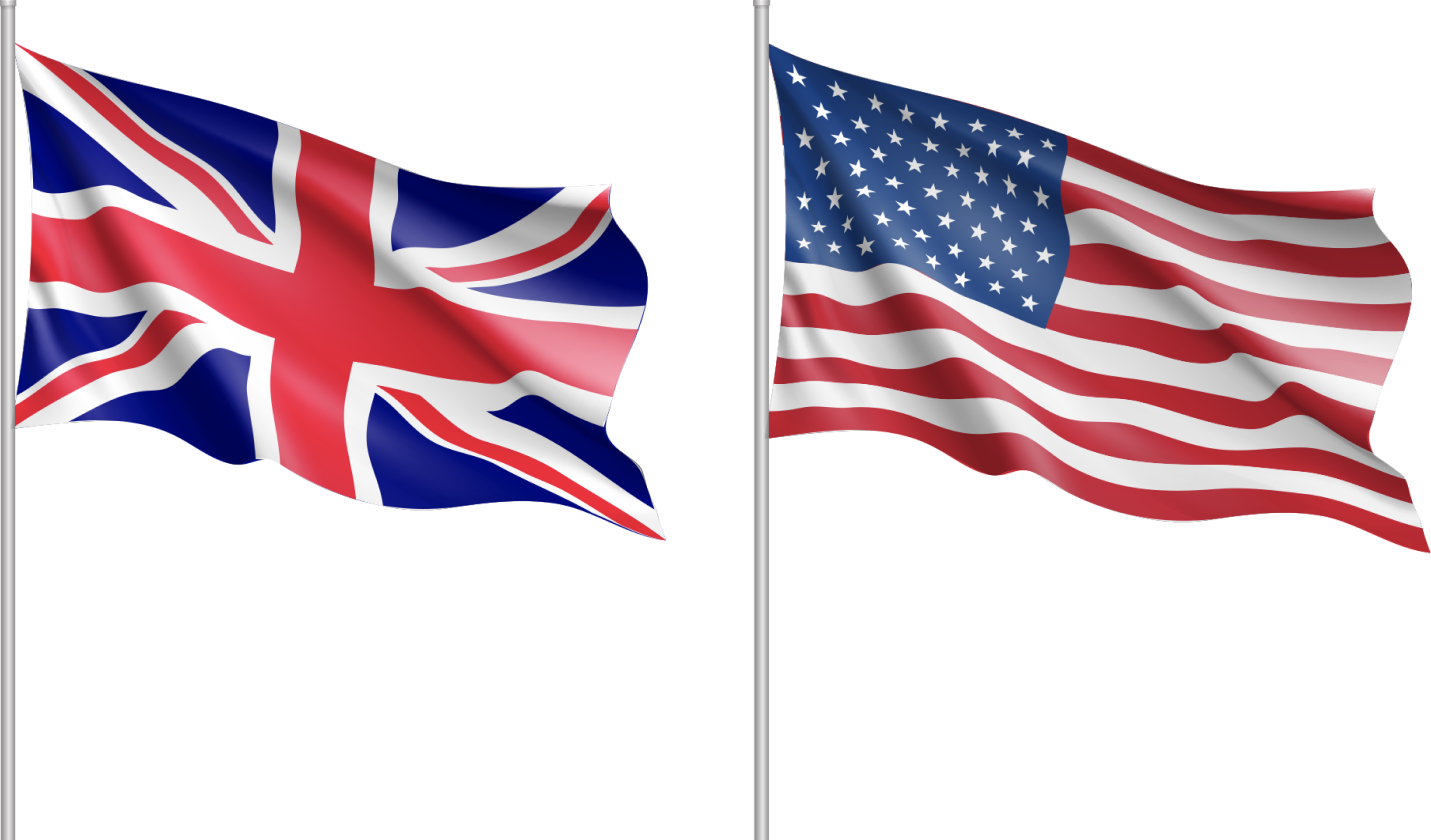

In 2020, we significantly expanded our global presence via API connection to London and New York. This opened up access to top RUB liquidity for clients all over the world. We extended our algorithmic presence to multi-dealer platforms: we are the first Russian bank to provide access to its algorithms to international banks via Bloomberg.

Outsourcing trading expertise

Global presence expansion

In 2021 we started providing our trading expertise for outsourcing as Trading-as-a-Service. We are translating Sberbank’s live FX quotes directly to another financial institution internet banking, so that its customers can actually see our base price. The next stage for evolution of this project is to enable automatic trading position hedging against our prices as well.

London

New-York

SME BANKING

Small is huge

For SME customers, Sber aspires to be not just a reliable financial partner providing convenient digital channels with accessible financing, smart cashflow management and highly personalized products, but also a technology-powered platform to streamline the workflow with innovative non-banking services—from bookkeeping, industry analytics, CRM, and online-promotion, to the newest payment and authorization methods for business online-platforms.

Digital innovations for better access to financing

A the unique bank's product for small and micro businesses inspired by AI-powered customer data analysis. Calculated individually for each customer, the maximum loan amount is 10 million rubles and the maximum loan term is 4 years.

Mobile loans for SME

Smart Loan

• First for Russia: the entire process is online and requires no paperwork or visits to a bank office

• Automatic data retrieval without requesting documents from the customer.

• Automatic data retrieval without requesting documents from the customer.

Covid-19. Government backed online financing

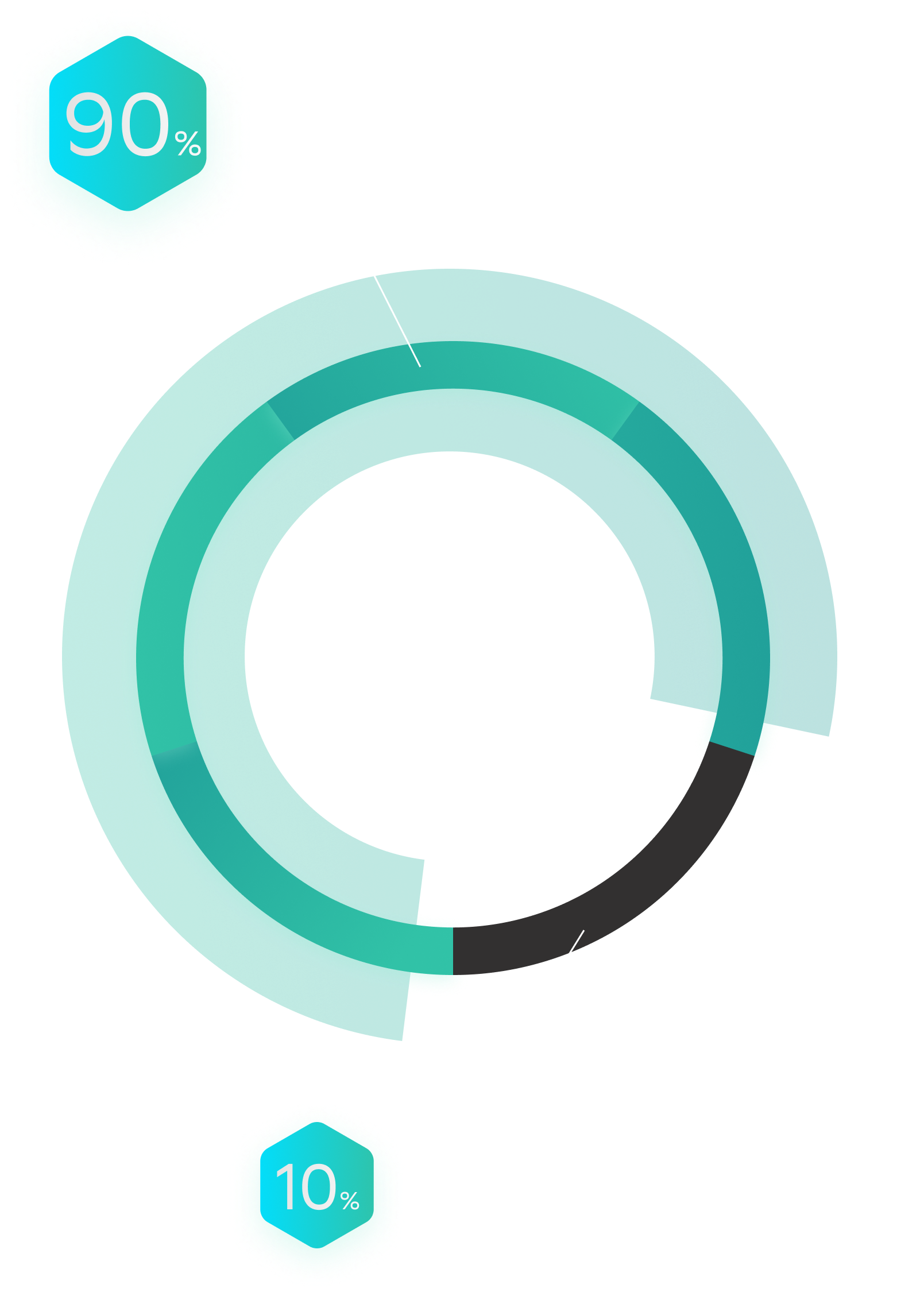

Sber is the only bank who offers end-2-end digital process for governmental financing programs. No visit to a bank or state authorities.

Personalization &

Data-powered services

Data-powered services

Our Data and AI capabilities allow us to create offerings precisely tailored to customer needs: personalized content, service bundles, industry-specific digital solutions. And our proprietary APIs ensure a seamless user experience across all services of the Sber ecosystem.

Business Apps

In 2021, we introduced smart add-ons for our online banking platform SberBusiness, designed for different businesses. In the web and mobile bank app, our SME customers can enable solutions tailored to their specific industry. In March 2021 the first Business App for Commercial Property was launched. We plan to extend the line of custom solutions to Transport, Services, Medicine, and other verticals till the end of the year.

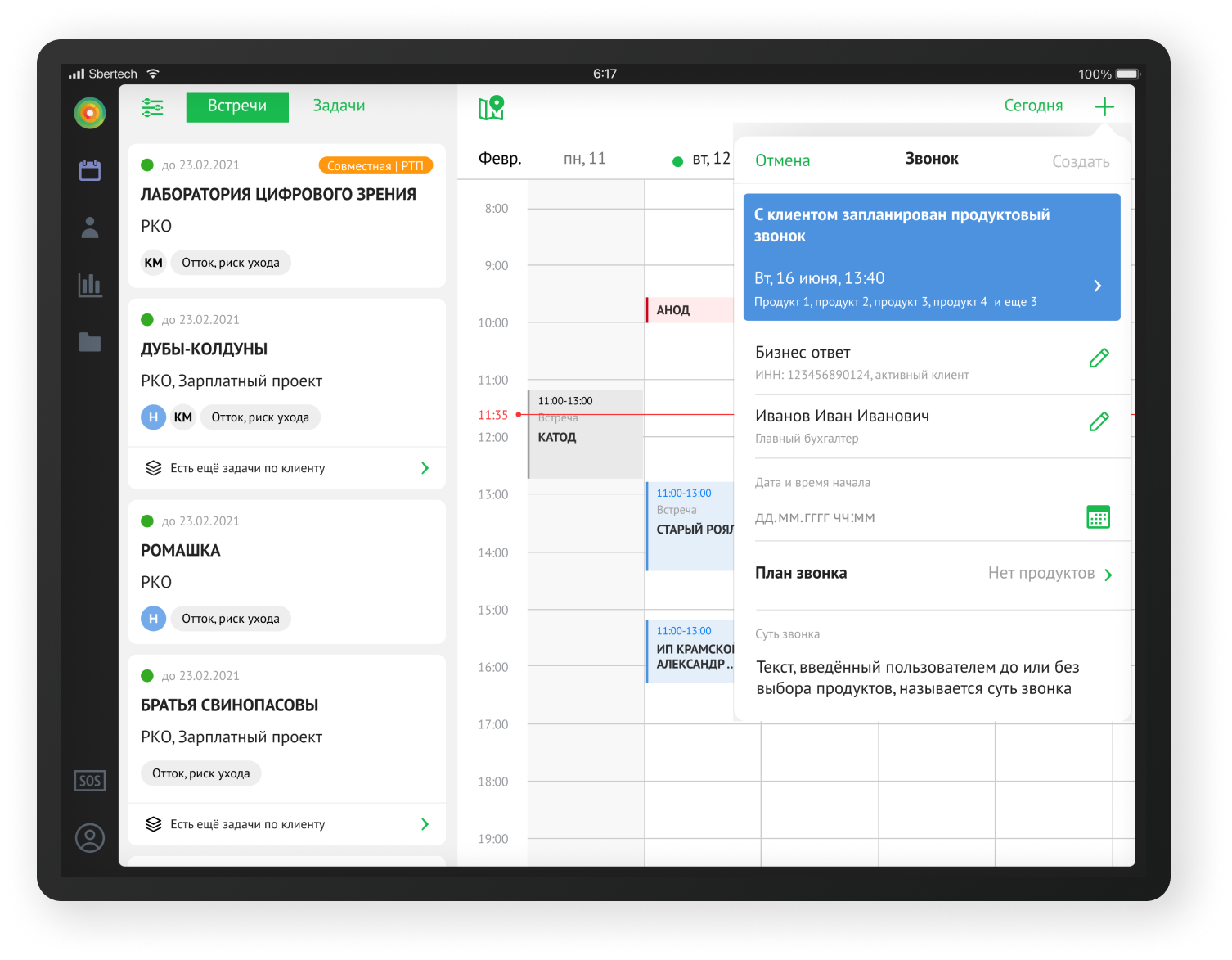

Smart customer interaction model

AI-algorithms help us identify highly potential customers. Customer service staff and workload depends on Relationship Potential Index, calculated by AI. In mobile app Compass customer relationship managers can find smart check-lists for meetings and calls with customers. Tasks are generated automatically (best offer, automatic compliance with the contact policy). Managers also can use a set of interactive materials for the presentation and tools for on-the-point sale.

Analytics for SME

Out-of-the-box analytical reports to assess company potential, define audience portraits, compare metrics with the competition, using big data and ML modeling.

Best in class digital services

For the last year, troubled by COVID-19, we made many of our digital services free in order to help our customers adapt to new challenges.

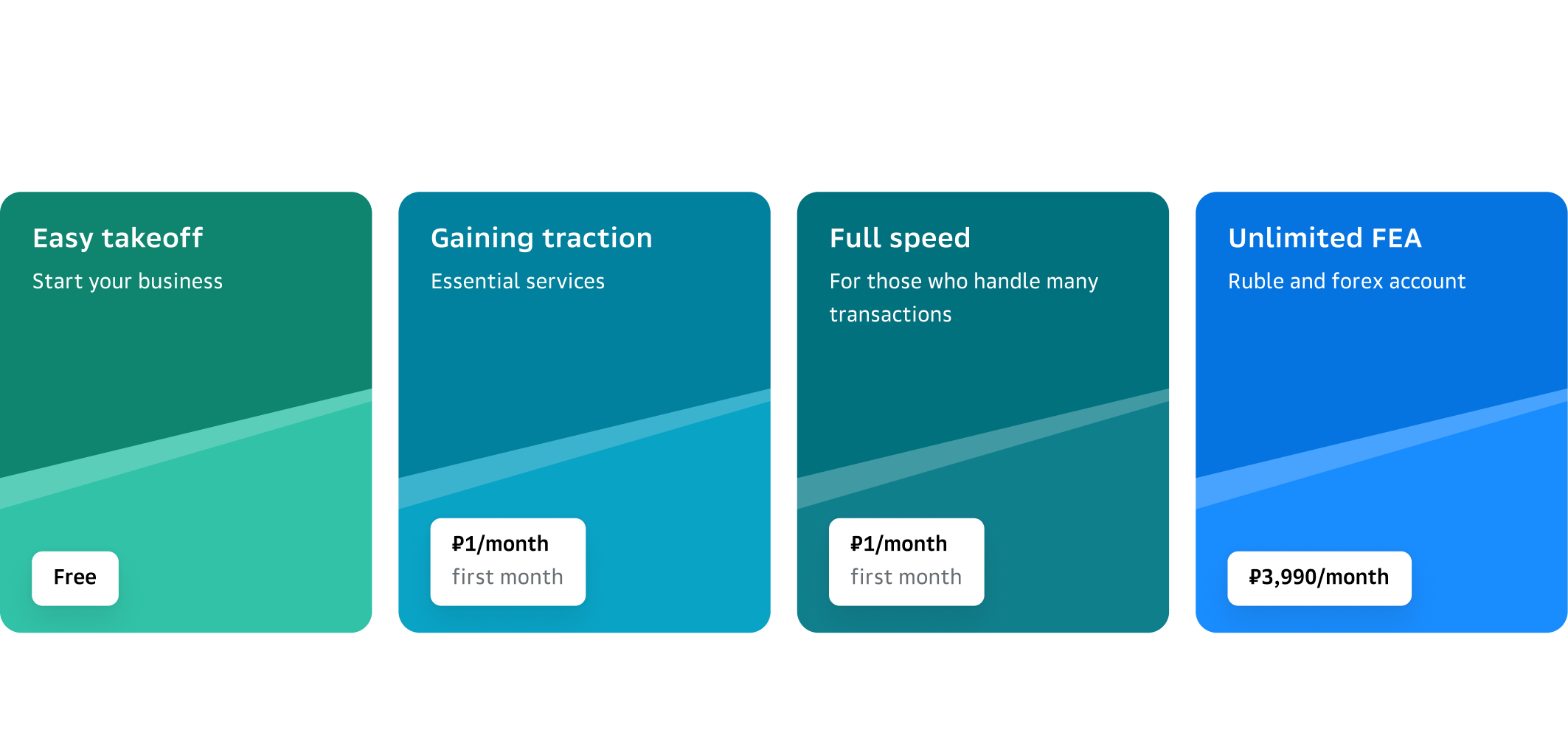

Services bundles & options

In the beginning of 2021 Sber introduced a new line of service bundles and options for small and medium-sized enterprises. Alongside the standard product set, a bundle includes such options as a free corporate card, lawyer’s consultation, free opening publication on Rabota.ru (job offer aggregator), and extra options including unlimited in-house cash-in-transit, unlimited payments, FEA rubles, and unlimited transfers to individuals.

Own/partner company assessment service with the use of official and internal data sources, personal recommendations from the Bank, and business restriction risk identification.

SberLead

Risk Management

Sber Business Bot

Customer call processing automation in text channels. The bot is built on the Bank's NLP platform. Up to 20% cut in customer support costs reduction.

Platform for boosting sales in online retail. The service allows you to increase the conversion rate on your website. 50+ ready-to-use widgets for quick launch of advertising campaigns.

TECHNOLOGICAL LEADERSHIP AND INNOVATIONS

Innovative platform for technological transformation

Sber keeps building an innovative technological platform, laying the groundwork for a more intelligent way to operate. For these purposes, we employ data from multiple sources, artificial intelligence (AI), and cloud technologies to provide maximum automation, adjust the level of straight-through processing, and accelerate distribution of new and personalized products in the market.

Channels

General Applied Services

Product Factories

Data Factory

General Tech Services

SberCloud

Data storage & Analytics

Customer Profile

Most of Sber’s strategic initiatives are based on deep understanding of our customers. The system architecture allows storing an unlimited scope of customer activity data.

Blockchain

As part of the state support for pandemic-stricken industries, the Bank established a connection to the blockchain platform of the Federal Tax Service of Russia. Thanks to its technological maturity, Sberbank was the first bank to connect to the FTS Russia's distributed registry and upload the first transactions.

companies received support under state programs

Artificial intelligence

One-click smart integration of banking and non-banking service bundles.

Customer support

Smart pricing

Cloud Infrastructure

Dynamic Infrastructure

and cloud platform.

and cloud platform.

Sber activly adopts artificial intelligence to achieve customer support greatness.

Integration with Governmental Bodies

Any transaction that modifies customer data undergoes online inspection via governmental resources.

Machine learning & Biometry

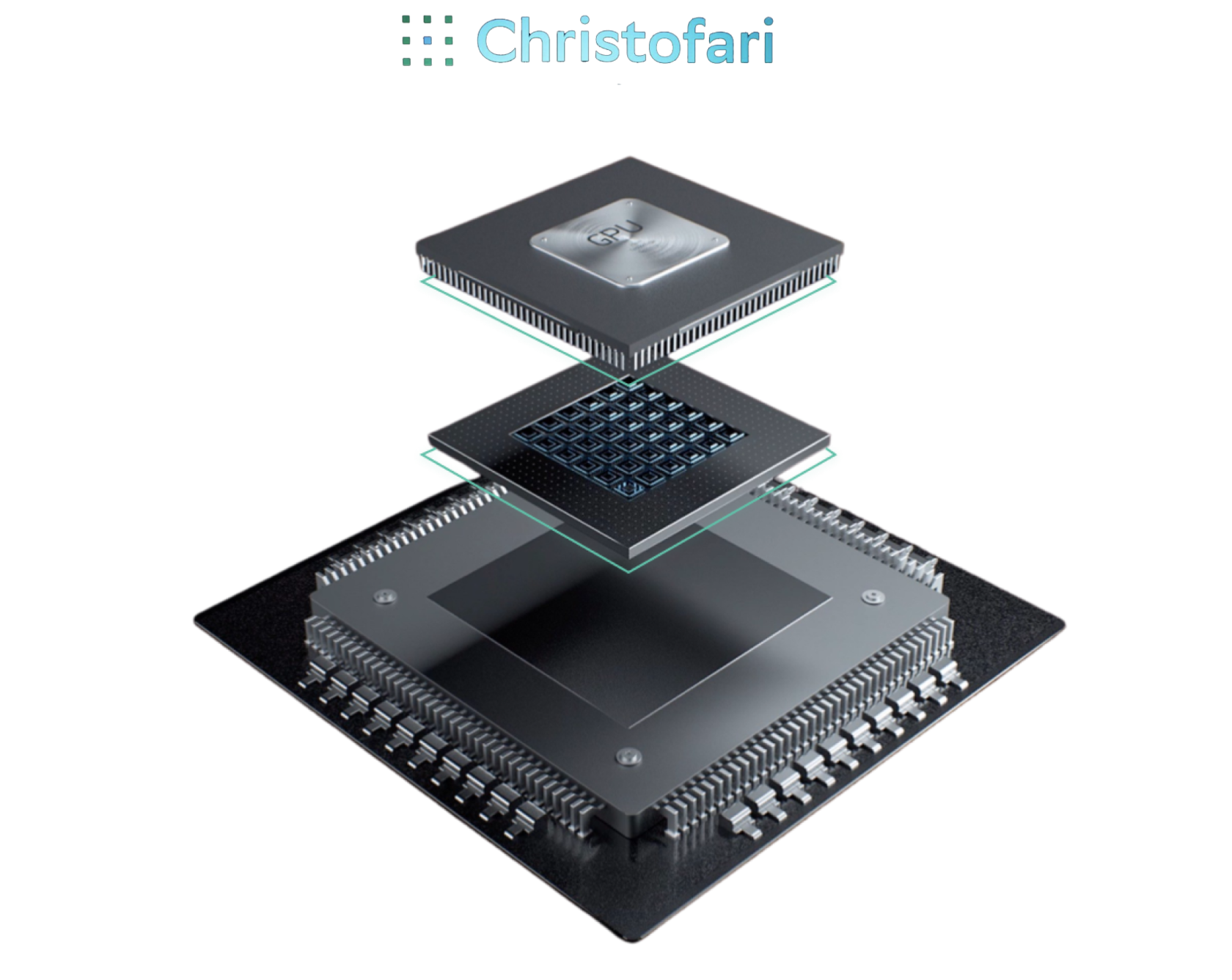

Christofari

We created Christofari—a supercomputer for processing big data and developing AI initiatives. Christofari is the only Russian supercomputer designed specifically to work with AI algorithms. With its help in 2020 the time spent for training AI models shortened from months to days and even minutes.

Christofari’s capacity is available for Sber corporate customers, who use SberCloud*.

Christofari’s capacity is available for Sber corporate customers, who use SberCloud*.

*SberCloud provides its cloud-based services to Sber, the ecosystem companies and external customers (corporate, academic, scientific, and governmental entities).

Application of ML models

An ML model made of several modules on different sources of internal and external data, with a connection graph. It is used to define the internal corporate customer relations strategy. The model managed to reduce risks of account blockings by 38%.

An ML model used for quality assurance and identifying chats with the highest negative response/error probability in customer service. Error identification accuracy: 30%.

An ML model used for quality assurance and identifying chats with the highest negative response/error probability in customer service. Error identification accuracy: 30%.

Biometric payments

In Q1 2021 Sber, X5 Retail Group, and Visa jointly introduced an innovative “pay-with-a-glance” service for self-service checkouts. Biometric payments are an innovative product, and implementing them is important both for Sber and for the market.

CYBERSECURITY

AND DATA PROTECTION

AND DATA PROTECTION

Uncompromising security level

The effects of the recession, including remote working and economic hardship, have created the perfect storm for the growth of cyberattacks and fraud. Cybersecurity and data protection always were Sber’s priorities. We keep constantly improving our systems to protect client data.

2020 became the fourth year in succession when Sberbank proved its compliance with, international requirements for monitoring and preventing cyber threats.

The first ever independent assurance of the bank’s compliance with the requirements of SWIFT CSP was conducted by an external audit company.

Smart anti-fraud system

SberBank Anti-Fraud System is a unique platform aimed at countering cyber fraud. All customer service channels are connected to a single anti-fraud platform and evaluate their operations in one multichannel anti-fraud system (transaction scoring). Currently, all customer service channels are connected to this platform, which enables having a risk profile of customer behavior in all the channels.

BigSecurityData (a separate analytical system) is used to enrich the fraud monitoring system models with data from internal and external sources.

ML models to detect anomalies and transactions scoring.

Collaboration with the 4 largest telecom operators enables real-time exchanging information on risk events such as virus infection, change of SIM cards, change of owner, etc.

Feedback form on the website allows clients to report suspicious phone numbers and websites.

ML models to detect anomalies and transactions scoring.

Collaboration with the 4 largest telecom operators enables real-time exchanging information on risk events such as virus infection, change of SIM cards, change of owner, etc.

Feedback form on the website allows clients to report suspicious phone numbers and websites.

financial transactions monitored monthly

events checked with in-memory data

uniqly short response time

models & algorithms used

to analyze information

data sources used

SOCIAL MEDIA MARKETING AND SERVICES

Bringing value, trust

and emotional connection

and emotional connection

Our social media communities are a true business partner. Anytime online and ready, this companion provides new business growth insights. Previously, our social media as a communication channel was only supposed to address reputation matters. In 2020, our key mission was to demonstrate that social media promotion can deliver substantial results.

Ecosystem and efficiency

Business Environment:

learning and expertise

learning and expertise

Easy Investing: knowledge

and tools for novice investors

and tools for novice investors

SberBusiness: cases, lifehacks, solutions for SMEs

My Business: inspiring stories and helpful tips for those who want to start their own business

SberPro: industry news, trends, analytics for corporations and public sector

Lightning-fast social

media response

media response

Conveniently packed content

Social impact

To render support to businesses in these tough times, we gathered top-grade business experts, notorious entrepreneurs, and real small business owners. Sber proposed recession-resistant products that addressed the problems of small and medium-sized companies.

Remote Business Talk Show

In a few days in the midst of the lockdown, we created a brand new content product, Remote Business talk show with a star host, famous journalist Aleksey Pivovarov. The concept was centered around talking to entrepreneurs at their places and discussing how they managed to adapt their business to lockdown.

Business Class

Jointly with Google, we provided free access to online courses full of vital knowledge to reinforce skills and expertise of entrepreneurs and their teams. These courses helped those who lost their job find new ways to earn and succeed. In 2020, we launched a dedicated course for Generation Z.

SberBusiness Live Forums

Pressed by the coronacrisis-related restrictions, we had to transform our offline forums into safe online sessions. Such

a switch let us invite prominent speakers and acquire more customers from different regions of Russia. During the project, we shared with our viewers a ton of invaluable lifehacks from entrepreneurs and business experts.

Promoting entrepreneurship and self-employment

As a banking service leader, Sber is actively promoting the image of entrepreneurship in Russia. Our media projects boosted the desire to become an entrepreneur (6% gain) among people.

Season 5 of 'I'm the Boss Now' was focused on online businesses. Viewers learned the secrets behind major companies and advantages of Sber's online services.

First business-campaign TikTok

'I’m the Boss Now. Online'

Entrepreneurs get younger and use new social media. We want to always be on the same page with our audience. Following this notion, we launched our first advertising campaign on TikTok. We partnered with well-known influencers and explained the young enthusiasts why knowledge is crucial for starting a company.

'Day F' game for the self-employed

We wanted to inspire our audience to unleash their talents, be brave to do what they love—and earn on that with Sber's services for the self-employed.

The number of self-employed registered with Sber grew 8 times over 2020.

The number of self-employed registered with Sber grew 8 times over 2020.

OPEN

BANKING

API

BANKING

API

SberBusiness API is a Catalyst to Upgrade and Simplify

With the proprietary API Sber makes its technological infrastructure available to third parties—thus significantly transforming corporate banking and forming new relationships with market players. The goal of the SberBusiness API product family is to improve the quality of customer service and enable third parties to use and analyze bank data.

Host-2-host integration with the bank and access to the bank infrastructure

• Standardized business processes

• Less manual routine

• Minimized paperwork errors

• Customized solutions

• Easy integration process with ‘off-the-shelf’ solution.

• Less manual routine

• Minimized paperwork errors

• Customized solutions

• Easy integration process with ‘off-the-shelf’ solution.

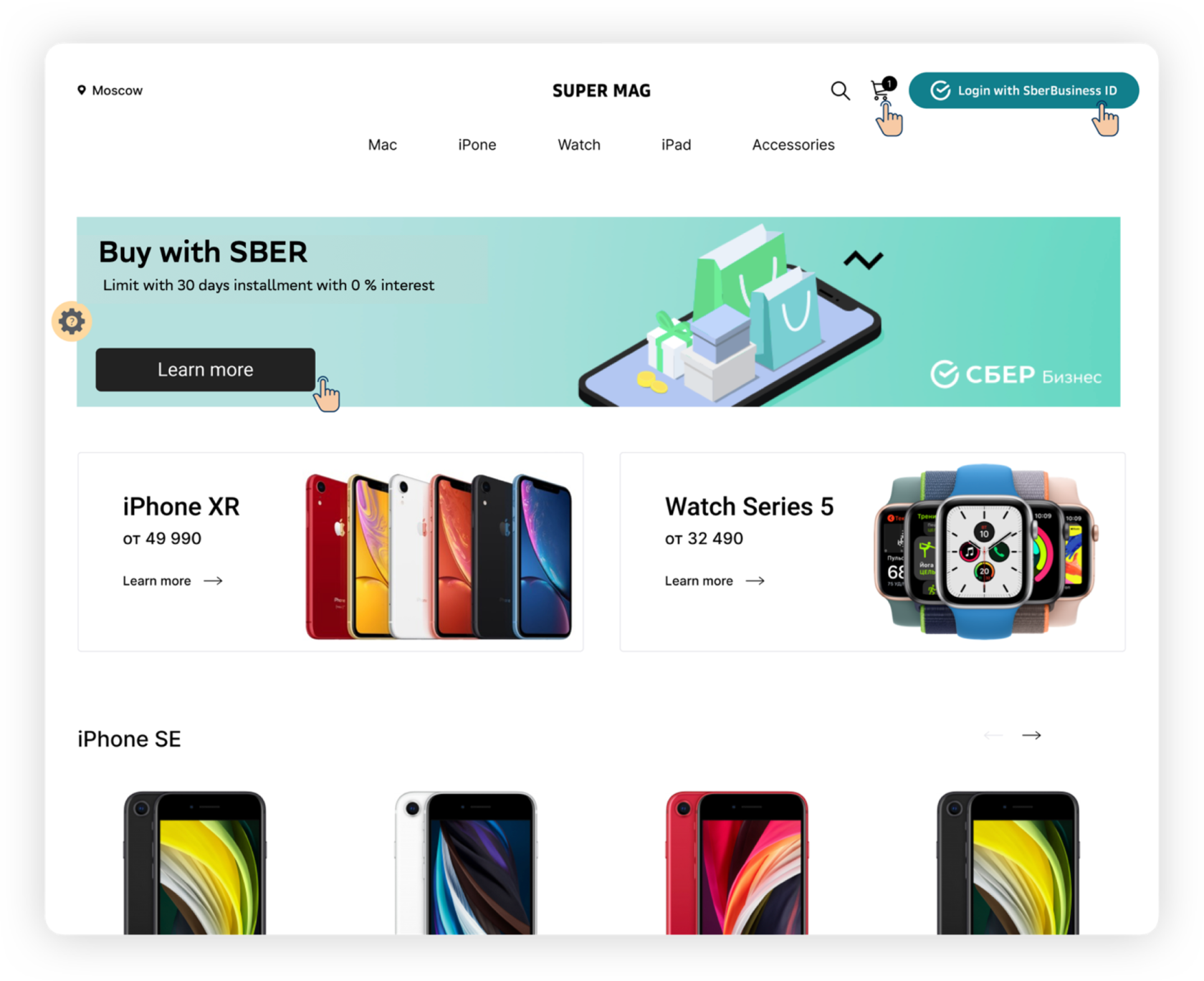

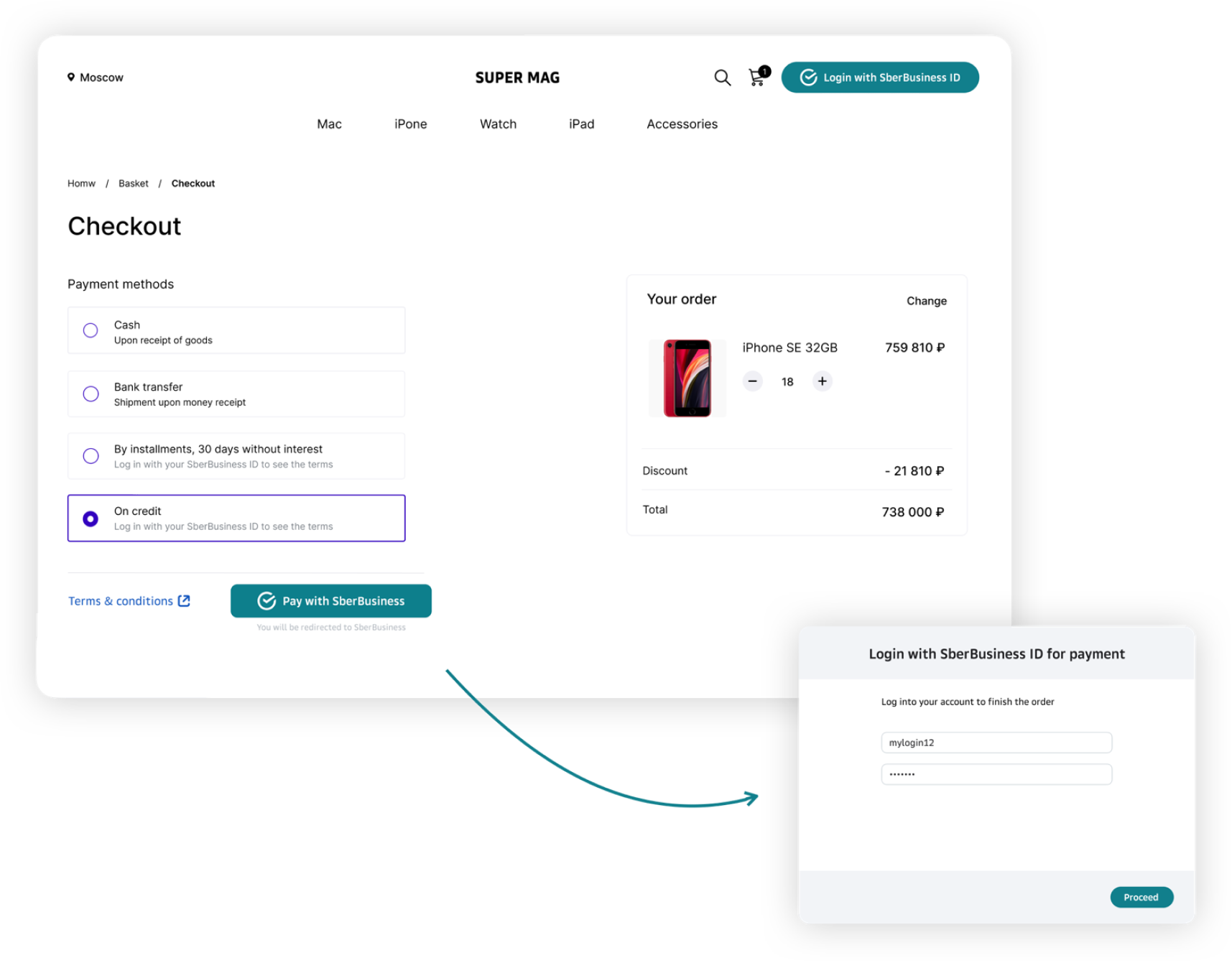

SberBusiness ID is a single account for a company representative—e.g., the CEO or an accountant. With SberBusiness ID, business customers can easily and quickly access corporate products and services from Sber and Sber partners.

Basically, SberBusiness ID allows user to create a complete profile for any service. Having created it once, user will never have to tediously enter a ton of details like TIN, account number, and others.

Basically, SberBusiness ID allows user to create a complete profile for any service. Having created it once, user will never have to tediously enter a ton of details like TIN, account number, and others.

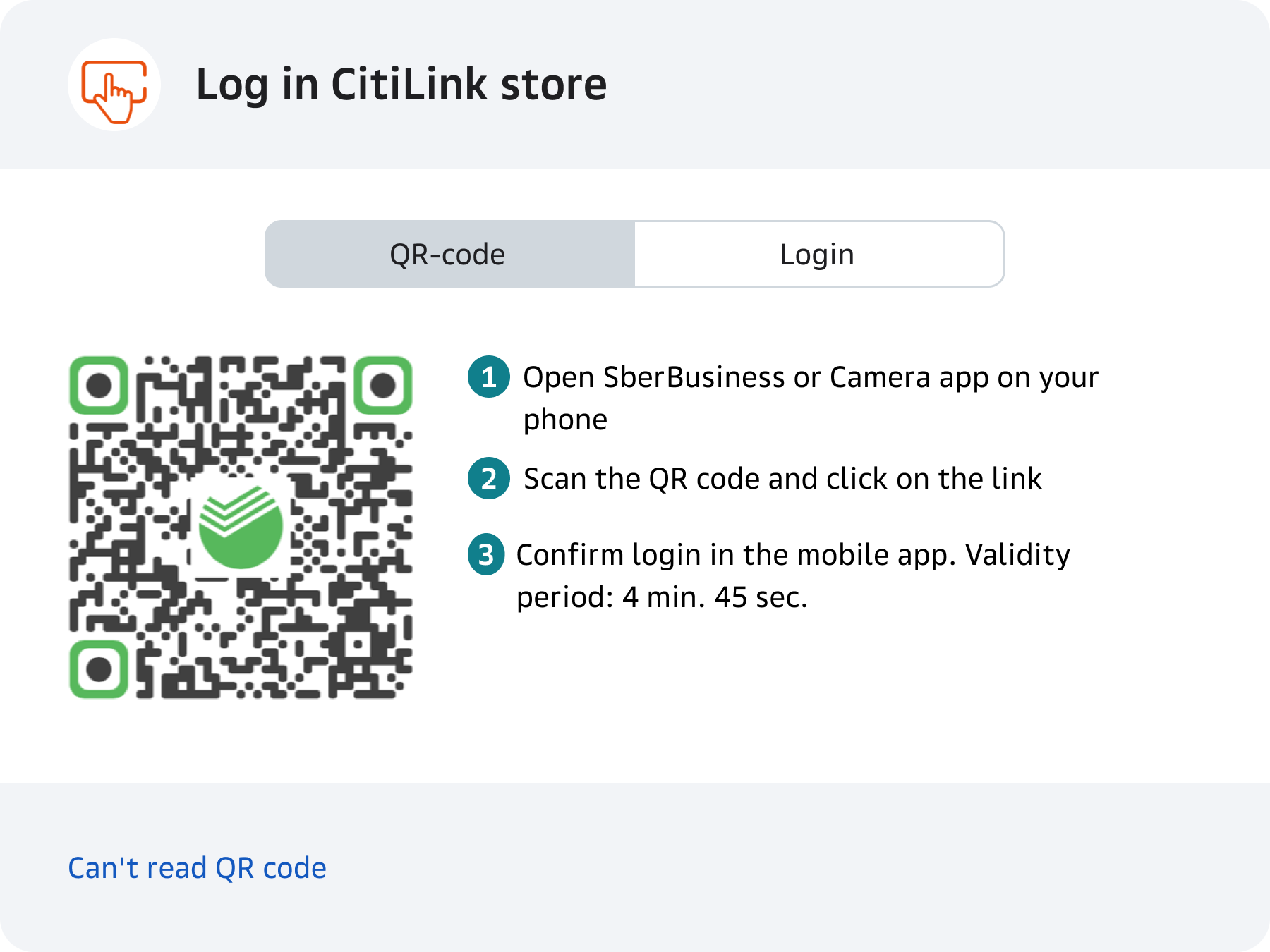

Single-sign-on Authentication

Online-marketplaces

B2B SaaS

FoodTech

Online-health

Taxi

HRTech

We allow our corporate customers to integrate ‘Sign In with SberBusiness ID’ on their websites to provide their clients with easy and quick authorization experience. To deploy the ‘Sign In with SberBusiness ID’ button, business has to follow the integration guide here: https://developers.sber.ru

Intelligent payment automation

Using SberBusines Payments – a bunch of API methods, fintech companies are able to provide financial services to consumers, including access to accounts opened with the bank. Sber was a pioneer in bringing a whole new experience in B2B-payments market in Russia.

Instant B2B-payments

For one-time product purchases.

For online stores and marketplaces—companies that seek to automate sales and increase conversion for their B2B customers.

For online stores and marketplaces—companies that seek to automate sales and increase conversion for their B2B customers.

How it works:

B2B-subscriptions

For reccuring payments.

For companies using the subscription model, including B2B-SaaS services, housing and utilities, telecom and Internet providers, movie and music subscriptions, taxi services, and others.

For companies using the subscription model, including B2B-SaaS services, housing and utilities, telecom and Internet providers, movie and music subscriptions, taxi services, and others.

How it works:

Secure transactions

Advance payment debiting, fund holding with subsequent debiting/cancelation.

The service is designed as a fix for the uncertainty of online transactions and can be built into a corporate customer’s site.

The service is designed as a fix for the uncertainty of online transactions and can be built into a corporate customer’s site.

How it works:

In late 2020, we introduced POS loans, a service that allows SMEs to purchase goods and services from suppliers on their B2B platforms using funds borrowed from the bank.

The loan approval process only takes a few minutes, with no guarantors required and the agreement signed in the electronic form. Credit funds can be used to pay for purchases, while manual creation of payment orders is not required.

The SberBusiness API solution has made it a-few-steps-easy for our partners—suppliers of goods and services—to integrate this payment method. No complicated processes or additional resources: we offer an off-the-shelf solution.

The loan approval process only takes a few minutes, with no guarantors required and the agreement signed in the electronic form. Credit funds can be used to pay for purchases, while manual creation of payment orders is not required.

The SberBusiness API solution has made it a-few-steps-easy for our partners—suppliers of goods and services—to integrate this payment method. No complicated processes or additional resources: we offer an off-the-shelf solution.

POS loans for B2B customers